Bank CEO Economic Forecast: Cloudy with a Chance of Recession

WBA Releases Results of Bank CEO Economic Conditions Survey

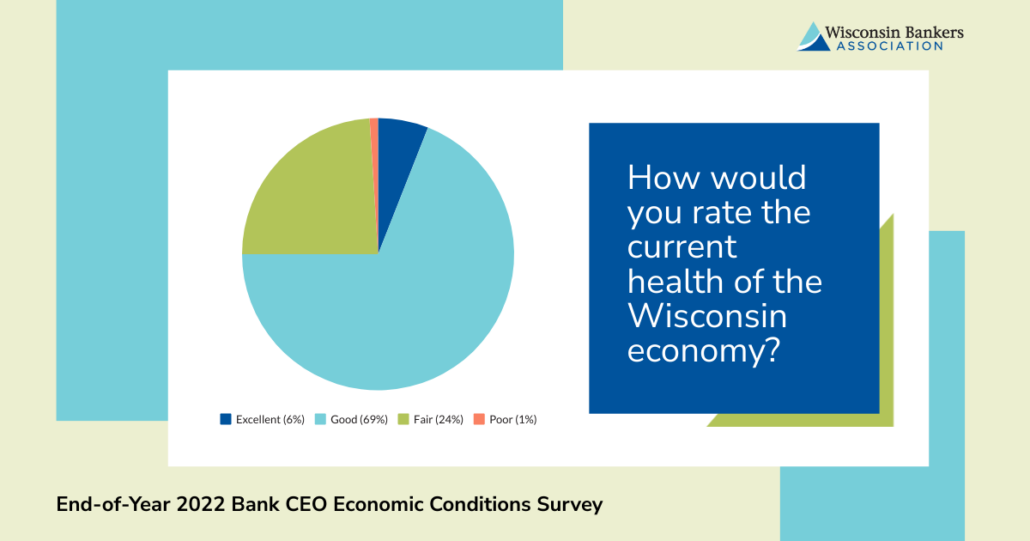

In the Wisconsin Bankers Association’s biannual Economic Conditions Survey of Wisconsin bank CEOs, three quarters of respondents rated Wisconsin’s current economic health as “excellent” or “good.” This continues a trend from the mid-year 2022 survey, when 71% of survey respondents gave “excellent” or “good” ratings. None of the Wisconsin bank CEOs who completed the most recent survey foresee major economic improvement in the first half of 2023 — 28% predict that the economy will stay the same and 72% predict it will weaken in the next six months.

“Because they are in tune with the financial circumstances of businesses and families in their areas, bank CEOs are experts who can apply a lot of context to their economic perspective,” said WBA President and CEO Rose Oswald Poels. “With the likelihood of a recession in the coming year looming, banks are standing ready to help their customers and communities through.“

Among the economic bright spots cited by CEOs in the survey were high employment, continued spending by consumers, the housing market, and business growth — particularly in manufacturing, agriculture, and service/tourism. Top economic concerns reported by bank CEOs were inflation, the likelihood of recession, rising interest rates/slowed loan growth/reduced ability of borrowers to repay loans, business staffing, cybersecurity/fraud, and inability to access childcare.

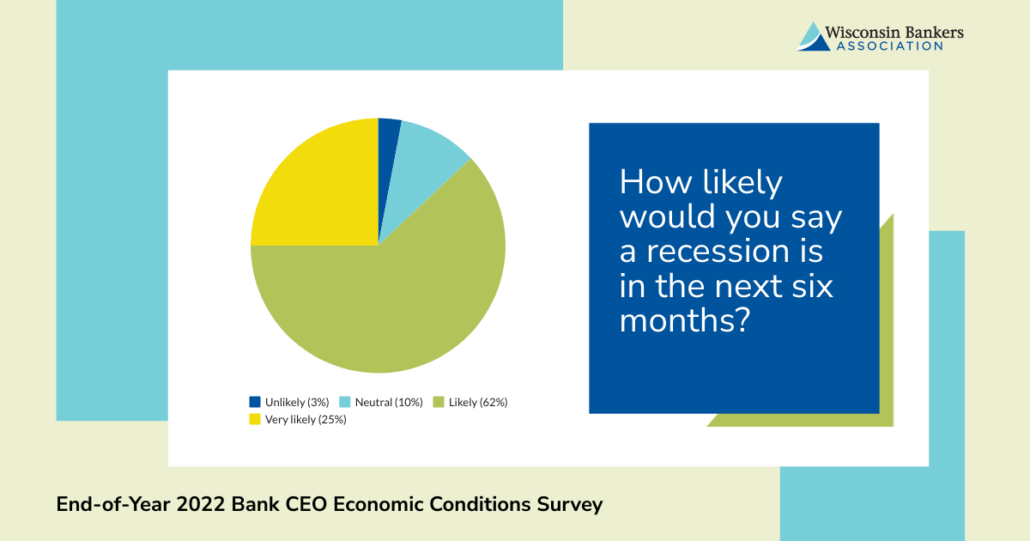

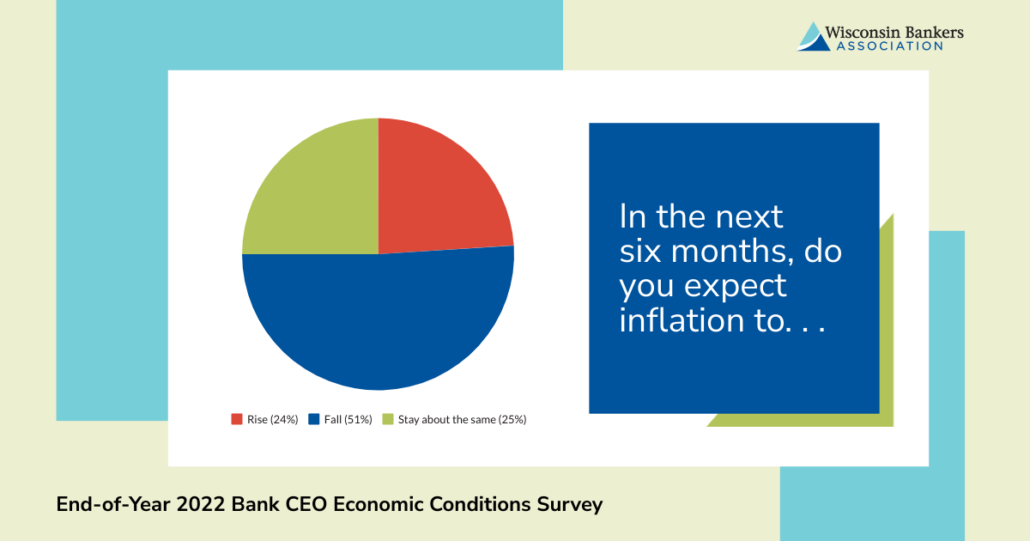

The end-of-year 2022 survey was conducted November 15–30 with 71 respondents. Sums may not equal 100 percent due to rounding. Below is a breakdown of the survey questions and responses.

Wisconsin Bank CEO Economic Conditions Survey Results

| How would you rate the current health of the Wisconsin economy? | End-of-Year 2022 | Mid-Year 2022 | End-of-Year 2021 |

| Excellent | 6% | 7% | 6% |

| Good | 69% | 64% | 73% |

| Fair | 24% | 29% | 20% |

| Poor | 1% | 0% | 1% |

| In the next six months, do you expect the Wisconsin economy to… | |||

| Grow | 0% | 2% | 21% |

| Weaken | 72% | 63% | 15% |

| Stay the same | 28% | 36% | 64% |

| Over the next six months, do you expect inflation to… | |||

| Rise | 24% | 50% | – |

| Fall | 51% | 22% | – |

| Stay about the same | 25% | 28% | – |

| How likely would you say a recession is in the next six months? | |||

| Very unlikely | 0% | 4% | – |

| Unlikely | 3% | 16% | – |

| Neutral | 10% | 20% | – |

| Likely | 62% | 45% | – |

| Very likely | 25% | 16% | – |

| Rate the current demand in the following categories: | |||

| Business Loans | |||

| Excellent | 3% | 2% | 9% |

| Good | 44% | 48% | 48% |

| Fair | 46% | 48% | 39% |

| Poor | 7% | 2% | 5% |

| Commercial Real Estate Loans | |||

| Excellent | 6% | 7% | 11% |

| Good | 34% | 52% | 44% |

| Fair | 53% | 36% | 41% |

| Poor | 7% | 5% | 4% |

| Residential Real Estate Loans | |||

| Excellent | 4% | 2% | 25% |

| Good | 7% | 20% | 48% |

| Fair | 33% | 50% | 24% |

| Poor | 55% | 29% | 3% |

| Agricultural Loans | |||

| Excellent | 3% | 2% | 1% |

| Good | 23% | 37% | 22% |

| Fair | 60% | 51% | 58% |

| Poor | 13% | 10% | 18% |

| Deposit | |||

| Excellent | 3% | 5% | – |

| Good | 44% | 55% | – |

| Fair | 44% | 38% | – |

| Poor | 9% | 2% | – |

| In the next six months, do you anticipate the demand for the following categories will… | |||

| Business Loans | |||

| Grow | 8% | 11% | 28% |

| Weaken | 56% | 48% | 14% |

| Stay the same | 35% | 41% | 59% |

| Commercial Real Estate Loans | |||

| Grow | 1% | 13% | 24% |

| Weaken | 63% | 48% | 21% |

| Stay the same | 35% | 39% | 55% |

| Residential Real Estate Loans | |||

| Grow | 6% | 4% | 11% |

| Weaken | 54% | 63% | 56% |

| Stay the same | 41% | 34% | 33% |

| Agricultural Loans | |||

| Grow | 15% | 6% | 15% |

| Weaken | 38% | 31% | 14% |

| Stay the same | 48% | 63% | 71% |

| Deposit | |||

| Grow | 13% | 11% | – |

| Weaken | 38% | 36% | – |

| Stay the same | 49% | 53% | – |

| In the next six months, are the businesses in your bank’s market area likely to… | |||

| Hire employees | 17% | 31% | 68% |

| Maintain current staffing levels | 71% | 61% | 33% |

| Lay off employees | 11% | 7% | 0% |

| In the next six months, is your bank likely to… | |||

| Hire employees | 23% | 34% | 55% |

| Maintain current staffing levels | 73% | 63% | 43% |

| Lay off employees | 4% | 4% | 3% |