Bankers are Prepared for Challenges

Wisconsin Bankers Association

Wisconsin Bankers Association

By Rose Oswald Poels, WBA President and CEO

Wisconsin banks are well positioned to help their customers and communities navigate through 2023, which is expected to be a more challenging year economically. With interest rates rising dramatically throughout last year, banks’ profitability has increased to a net interest margin of 3.19% in the third quarter of 2022.

All categories of lending have seen increases both on a quarter-over-quarter basis, as well as year over year. Residential loan demand continued to grow at a steady pace, up 5.25% from the prior quarter, and 10.23% from the prior year, despite rising interest rates, due in part to a decline from a high in home prices. Commercial lending saw ongoing strong demand year over year with an increase of 10.04%, although the third quarter grew at a slower pace of 2.25% from the prior quarter, signaling business owners’ concerns around inflation, a potential recession, and uncertainty heading into the midterm elections. Finally, farm loans increased 5.80% quarter over quarter and 6.79% year over year, representing a consistent pace of borrowing in light of higher input costs such as fuel and fertilizer.

Also demonstrated in the 2022 third quarter numbers is the strong financial health of Wisconsin bank borrowers. Credit quality remains very strong with loans and leases 90 or more days past due continuing their downward trend, remaining at historic lows. Noncurrent loans compared to total loans is now at .40% — which is essentially negligible. Borrowers are keeping on top of their monthly loan payments, even through this inflationary period. Consumers are tapping into their savings to offset higher food and energy prices, and to pay down debt. The pace of deposit growth at Wisconsin’s banks has slowed, where total deposits grew only 1.45% from the prior quarter, and just 3.83% year over year.

On a national level, economic data is consistent with the themes seen from the banking industry’s data. Real personal consumption expenditures, which account for about 70 percent of real GDP, continued to expand during the first half of 2022, albeit at a slow pace. Other important economic indicators, such as payrolls, industrial production, and manufacturing activity, also slowly

expanded in the first half of the year, while real retail sales and real personal income were mostly flat.

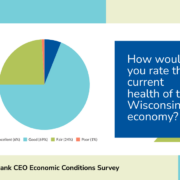

Looking ahead, bankers are in a unique position given their insight into the financial well-being of their individual and business customers to share thoughts as to what 2023 could bring. WBA conducted an end-of-year survey between November 15–30 with 71 bank CEOs responding to our Economic Conditions Survey. While there are some bright spots in the survey results, bankers are concerned about a looming recession.

Three quarters of respondents rated Wisconsin’s current economic health as “excellent” or “good.” This continues a trend from the mid-year 2022 survey, when 71% of survey respondents gave “excellent” or “good” ratings. None of the Wisconsin bank CEOs who completed the most recent survey foresee major economic improvement in the first half of 2023 — 28% predict that the economy will stay the same and 72% predict it will weaken in the next six months. Given the likelihood of a recession in 2023, bankers are understandably concerned about borrowers’ continued ability to repay loans, and the effect ongoing rising rates will have on slowing economic growth even further.

Among the economic bright spots cited by CEOs in the survey were high employment, continued spending by consumers, the housing market, and business growth — particularly in manufacturing, agriculture, and service/tourism.

High inflation and the Federal Reserve’s response to it are certainly concerns heading into 2023. The Federal Reserve’s tightening has been aggressive throughout 2022, and while it is expected that the Federal Reserve will continue to raise rates in 2023 to combat inflation, it likely will do so in smaller increments than what was seen last year. More time needs to be given to let the effect of these rate hikes work their way through the system before another major increase occurs.

Despite concerns looming about a recession, Wisconsin consumers and business owners will be able to continue to rely on their banks as a source of trusted financial partnership and a safe place to deposit their money.

Founded in 1892, WBA is the state’s largest financial industry trade association, representing more than 200 commercial banks and savings institutions, their branches, and over 30,000 employees. The Association represents banks of all sizes in Wisconsin, and nearly 98 percent of banks in the state are WBA members.