More Diversity, Equity, and Inclusion Resources

Below are a variety of resources that banks can utilize in their efforts surrounding diversity, equity, and inclusion (DEI). These resources have been curated by WBA and our DEI Advisory Group of members. To find out more, please contact one of the DEI Advisory Group’s WBA staff liaisons: Rose Oswald Poels, president and CEO; Lori Kalscheuer, director – education; or Cassandra Krause, director – communications.

Get Involved with the WBA Connect DEI Peer Group

WBA Connect is a collection of peer communities, designed to be a safe space to keep bankers connected and help one another grow. Membership in the WBA Connect DEI group comes with access to the group’s exclusive online peer-to-peer listserv, and four peer connection meetings per year.

Join WBA’s DEI Employee Resource Group (ERG)

WBA’s DEI ERG is designed to be a safe space for bankers to meet virtually for one hour approximately once per month in an open-forum discussion to share feelings, concerns, and frustrations as well as positive developments related to DEI.

Download a DEI Sample Policy For Banks

A customizable DEI Sample Policy is available for banks to use when implementing and/or revising their institution’s policy. The sample policy is designed to serve as a template or a discussion prompt to help banks develop and maintain policies that fit their organization’s specific mission, values, strategy, and policies.

WBA’s DEI Statement

View WBA’s statement on DEI above as an integral part of our mission and service to our members.

Partner to Serve

Access a list of CDFIs as well as ethnic chambers and other organizations in Wisconsin.

On-Demand Webinar: Understanding Unconscious Bias

Derek Mosley, a municipal court judge for the City of Milwaukee, presented a webinar on Tuesday, November 29 to guide bankers in recognizing, understanding, and mitigating our unconscious bias. This webinar, free to all WBA-member bankers, is a great opportunity for professional development, and a recording can be requested by contacting WBA’s Education team.

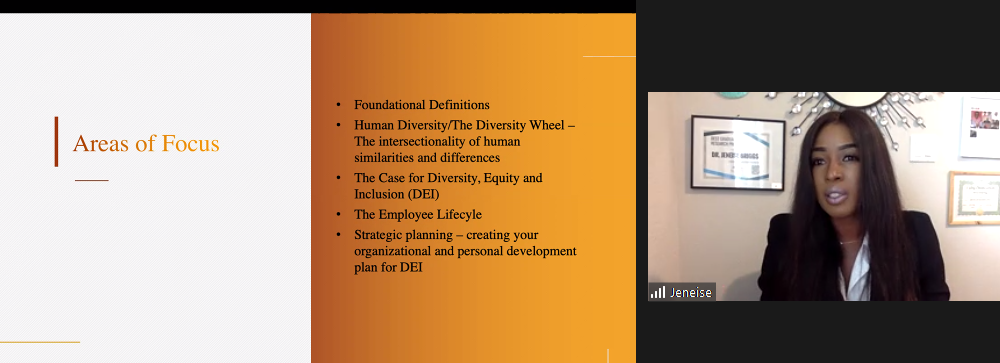

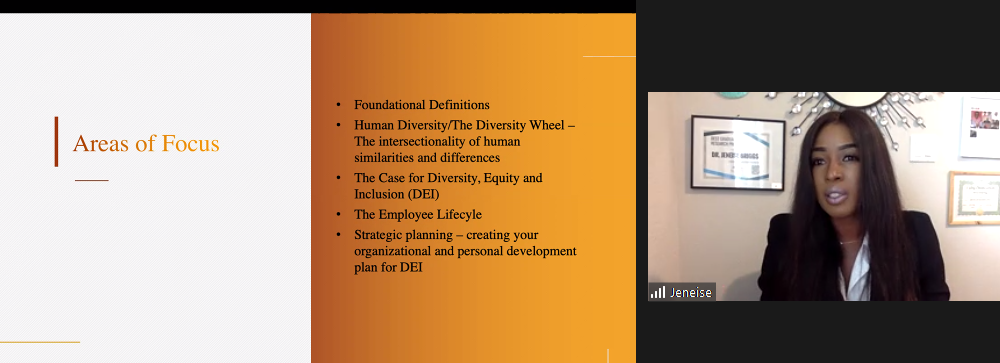

On-Demand Webinar: Applying an Equity Lens to the Employee Lifecycle — Recruitment & Hiring Process

The COVID-19 pandemic has disrupted our way of life and the way we do business across all sectors of the U.S. economy. Businesses and institutions across the United States continue to grapple with the effects of the great reshuffling of the U.S. workforce, changes in workers’ expectations, social and political turmoil, etc.

This 90-minute webinar recording will provide participants with strategies and tools to embed equity in their recruitment and hiring aspects of the employee lifecycle.

Contact WBA’s Education team to order your on-demand webinar access.

Resources from the American Bankers Association

For more DEI resources from one of WBA’s national partners, please visit ABA’s website.

- ABA Self-paced Online Courses

- Conscious Bias: This course will help banks’ customer-facing associates identify bias in the workplace and discover ways to approach such situations with self-reflection, coaching, and how to change biased behaviors. Most unconscious bias training does not have a self-reflection component, coaching, or other follow-up that could affect substantive changes in behavior. One’s biases may never go away; however, individuals can take steps to change their biased behaviors.

- Culturally Respectful Customer Service: Banks serve customers of all ethnicities, cultures, and generations. This course will help banks’ customer-facing associates develop the empathy and sensitivity needed to successfully meet the expectations of a diverse range of clients.

Financial Inclusion Resources

- Bank On Greater Milwaukee is a collaboration between financial institutions, community-based organizations, and local government to ensure that all residents have the opportunity to be financially healthy. Together, we are working to connect people to safe, affordable, and certified banking accounts. Many Wisconsin banks already offer products that would qualify for certification or could qualify with small changes. Find out more and get certified.

- Wisconsin Saves encourages automatic savings by splitting payroll deposits into two separate accounts (one for saving, one for spending). When employers sign up to provide this employee benefit, they receive a toolkit to help them communicate about the program and its advantages to employees.

- BankWork$® is Employ Milwaukee’s occupational skill development program, which provides eight weeks of retail banking career training. Banks can sign up to become an employer partner to be connected to talented candidates for positions including bank teller, customer service representative, relationship banker, and personal banker.