Experts at the Wisconsin Economic Forecast Luncheon weigh in on what is in store for the remainder of the year

By Cassandra Krause

2024 Midwest Economic Forecast Luncheon

The Wisconsin Economic Forecast Luncheon — back in person for the second year post-pandemic — was presented on April 10, 2024, by the Wisconsin Bankers Association in partnership with WisPolitics and WisBusiness. Dr. Mark Eppli, director of the James A. Graaskamp Center for Real Estate at the University of Wisconsin–Madison Business School, gave the keynote address covering macroeconomics, the single-family housing market, the single-family mortgage market, and commercial real estate. A panel discussion, moderated by WisPolitics and WisBusiness’s Jeff Mayers, included insights from bankers and economists. The bankers were Doug Nelson, regional president, Johnson Financial Group; and Mike Olson, president and CEO of the Bank of Brodhead. The economists were Dale Knapp, of Forward Analytics, a division of the Wisconsin Counties Association; and Romina Soria, a senior economist at the Wisconsin Department of Revenue (DOR).

100% of Excess COVID Consumer Savings is Now Spent

Dr. Mark Eppli, University of Wisconsin–Madison

In his macroeconomic overview, Eppli noted that the Federal reserve has kept short- and long-term rates high — pushing mortgage interest rates and interest rate spreads dramatically higher — yet the U.S. gross domestic product (GDP) grew 3.1% in 2023 (compared to a 50-year average of 2.7%). He illustrated that while the Federal Reserve had its feet on the brakes, the president and Congress had their feet on the gas, so to speak, with federal deficit spending increasing $9.8T between Q1 of 2020 and Q4 of 2023.

Nationwide, the unemployment rate has remained under 4% for over two years, and Eppli pointed out that while Wisconsin’s employment growth since the pandemic has been below the national average, Dane County has been a source of employment growth for Wisconsin. However, Eppli referenced a January 2024 article in the Wall Street Journal that showed that job quit rates and job postings are in decline. Eppli predicted that the second half of 2024 will see less economic growth and less consumer spending, citing factors such as student loans going back into repayment and recent data from the Federal Reserve Bank of San Francisco indicating that pandemic-era excess personal savings has now been spent.

Wisconsin Housing Supply Remains Tight

Data from the Wisconsin REALTORS® Association (WRA) and the Graaskamp Center shows that Wisconsin residential sales are down 29% since a peak in 2021, and Eppli noted that a limited for-sale housing supply is hurting sales volume. Federal Reserve Economic Data shows Wisconsin’s listing inventory down 79% from 2016 levels. On top of many current homeowners having refinanced into mortgages with low interest rates, WRA data shows that home prices have nearly doubled in the last 10 years. This means that people are not moving, and Eppli predicts that long-term housing demand will remain robust while the inventory of for-sale homes will remain tight in 2024.

Commercial Real Estate Prices May Have Hit Bottom

To close his keynote presentation, Eppli covered the commercial real estate market. He pointed to data from the Green Street Commercial Property Price Index® showing that commercial property values are around the early COVID pricing lows and said that prices may have hit bottom by this point. He named retail and office spaces as particularly challenged areas of commercial real estate as demand is low. Offices, for example, have not only low demand but are also expensive to operate. On the other hand, Eppli described apartment and industrial commercial real estate market fundamentals as ‘solid’ and ‘very solid,’ respectively.

Housing Affordability and Cost of Living Among Top Concerns

(Left to right) Jeff Mayers, WisPolitics/WisBusiness; Doug Nelson, Johnson Financial Group; Dale Knapp, Forward Analytics; Mike Olson, Bank of Brodhead; Romina Soria, Wisconsin Department of Revenue

During the panel discussion, Bank of Brodhead’s Olson emphasized the importance of housing affordability to Wisconsin’s economy and noted that customers are coming to banks for education about what they can afford in terms of debt to income. When asked whether rental units can fill the housing inventory gap, Johnson Financial Group’s Nelson replied that they are only a safety valve for a point in time; units fill up quickly and prices go up. He stressed that everyone needs to have their eye on affordable housing. Knapp, of Forward Analytics, added that the cost of things like food and energy at home, as well as the cost of things like car insurance have gone up significantly, resulting in excess savings being drawn down. DOR’s Soria said that while some people will adapt to higher interest rates, others — particularly those who are in the bottom half of wealth percentile groups — will be priced out of buying a home. Soria also noted the issue of Wisconsin’s aging population and its implications for the state’s workforce.

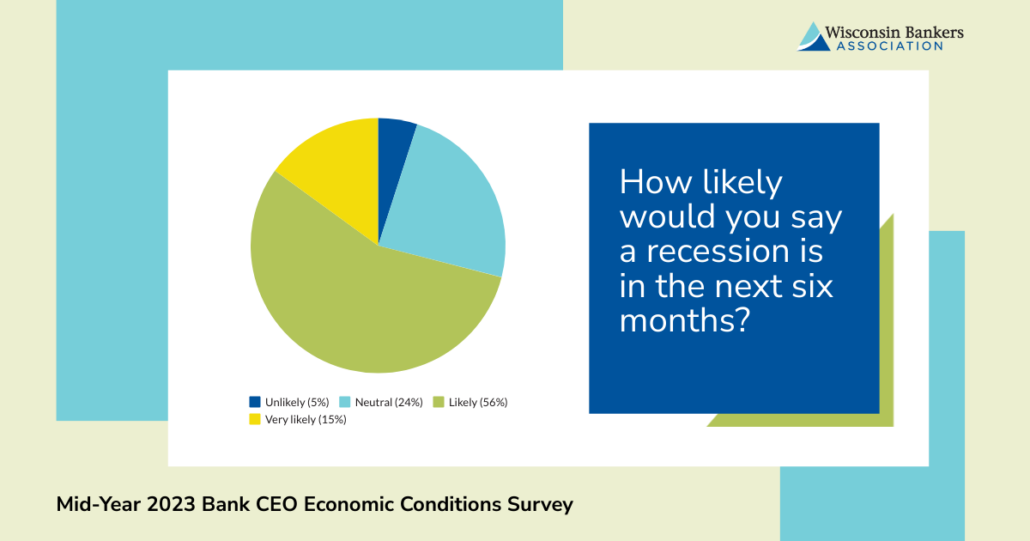

Will There Be a Recession in 2024?

The final topic of discussion amongst the panel was the possibility of a soft landing in 2024. Olson, who is both a banker and a farmer, drew a laugh from the audience when he likened economic forecasts to weather forecasts: “every year, somebody predicts a drought.” Though the panelists did not come to a clear consensus on exactly when the U.S. economy may experience its next recession, all agreed that the next recession is likely not as imminent as many outlooks from six months or a year ago had predicted.