Photo courtesy of PNC Bank

By Paul Gores

The term “mobile banking” typically involves financial apps on smartphones. But for some banks and credit unions, mobile banking also comes on wheels.

More credit unions and banks around the U.S. have been adding mobile branches — trucks or RV-type vehicles outfitted with banking gear ranging from ATMs to teller windows to private loan offices — to reach out to their customers.

Large regional banks doing business in Wisconsin, such as PNC Bank and U.S. Bank, have had mobile branches for years, and PNC is building a bigger fleet. But the vast majority of the nation’s community banks don’t have mobile units, and credit unions tend to own them more often than banks.

In fact, in Wisconsin, a state-based credit union soon will be operating a full mobile branch — a 34-footlong vehicle that is expected to hit the road for Westby Co-op Credit Union this spring.

“We’ll go where our members need us,” said Art Shrader, chief business development officer for the $763 million-asset credit union, also called WCCU. Mobile Facilities LLC in Elkhart, Indiana, is putting the finishing touches on Westby Co-op’s mobile branch, one of up to six the company produces each year for financial institutions.

Matt Fuller, president of Mobile Facilities, said he’s seen more orders and interest in mobile branches in recent years as financial institutions have pared back on branch locations.

“There’s a lot of branches closing everywhere, so they’re looking for other ways to reach out to these smaller communities where it just doesn’t make sense to have a brick-and-mortar branch anymore,” Fuller said.

Fuller said the mobile branches his company makes range from a 23-foot vehicle that costs about $159,000 to a 40-foot financial center on wheels that sells for around $295,000. The key feature of the 23-footer is an ATM, while the 40-footer can include just about whatever the financial institution wants, he said. “Some of them want teller windows on the inside, some want them on the outside. Some want restrooms, some don’t. Some want a lobby area, some want an office area,” Fuller said.

Mobile Facilities offers multiple mobile branch floor plans.

“We install restrooms, all the furniture and fixtures, of course air conditioning, heating, generators, wheelchair lifts on some of the bigger units,” Fuller said.

Fuller said the most popular mobile bank vehicles his company produces are its 29-foot and 34-foot units.

Photo courtesy of PNC Bank

The smaller Mobile Facilities mobile banks are built on a Ford E-450 Super Duty chassis, while the largest are crafted on a Freightliner M2 chassis. The vehicles use only two axles and weigh less than 26,000 pounds, which means they don’t need a specially licensed driver.

Fuller said it typically takes his company eight to nine months to complete a mobile branch vehicle.

Florida-based MBF Industries, Inc. (mbfindustries.com) is another supplier of mobile bank branches, including some built for PNC Bank.

PNC Bank is a big believer in the usefulness of mobile branches. It has a fleet of 12 so far in several sizes and expects to have 20 in all by the end of next year.

While PNC will dispatch the mobile branches to provide banking services where there’s been a natural disaster, its branches-on-wheels are used regularly as community outreach tools, said Chris Hill, senior vice president and PNC mobile branch channel manager.

When PNC Financial Services Chief Executive Officer William Demchak went through a new unit in 2018, he suggested the company build a fleet that could serve low- and moderate-income neighborhoods, Hill said. Now, working with community partners, PNC’s mobile units make regular visits to areas of Baltimore, Chicago, and Detroit, offering not only account-opening services but often financial education to people who might otherwise be outside of mainstream banking. The bank plans to expand the program to more major metro areas in the U.S.

“We have a 30-foot truck that we use for a variety of things, but it’s really what we use in our community outreach,” Hill said. “The employees don’t handle cash. We call it a cashless branch. So we don’t do any tellering services, but we do everything else.”

The unit includes a deposit-taking ATM, so people can make an account-opening deposit at the mobile branch. The bankers — there are always at least two — can issue debit cards on the spot.

“That’s pretty powerful for the consumer — we’ve come to them,” Hill said. “We haven’t asked them to come to us. We’ve brought banking to them.”

U.S. Bank has used its two mobile units mostly at natural disaster scenes. For instance, one unit went to the Bowling Green area when a tornado devastated parts of western Kentucky in mid-December last year.

“After a disaster our customers have appreciated the opportunity to bank right in their own town, typically near where the branch was,” said Doug Reier, senior vice president of operations process and delivery for U.S. Bank. “And our employees are happy to have a place to call a temporary home to work.”

Westby Co-op Credit Union’s Shrader said the new mobile branch is a way for the financial institution to serve all parts of its area better.

“We serve a rural area, and we have populations of Amish throughout the areas as well as non-Amish, and we need to go where our members need us,” Shrader said. “There’s a huge amount of benefits from this, from marketing to PR, but it’s to serve the membership plain and simple.”

He said he also expects that the mobile branch will make visits to offer banking services and financial education to places like schools, nursing homes, county fairs, and other community events.

Shrader said the credit union’s mobile branch will be able to do what a permanent brick-and-mortar branch can do, including lending.

Shrader said the credit union had to get permission for the mobile branch from the Wisconsin Office of Credit Unions, and its operation at first will be “a learning experience.”

Heather A. MacKinnon, vice president – legal for the Wisconsin Bankers Association, said state banks considering a mobile branch should contact the Wisconsin Department of Financial Institutions (DFI).

“From a state banking perspective, Wisconsin Department of Financial Institutions Banking Administrative Code has language referring to a branch location being ‘permanent,’ which may be a consideration to overcome as a concept of permanence is certainly different than ‘mobile,’” she said. “However, after having had informal conversations with DFI, WBA would encourage any bank seeking to file a mobile facility to engage with DFI as there is a willingness for discussions.”

Nationally, the Office of the Comptroller of the Currency requires a branch license for each mobile unit. The regulator defines a mobile branch as a facility that does not have a single, permanent site and includes a vehicle that travels to public locations to conduct branch transactions. It requires a bank to file an application delineating the proposed or expanded geographic area to be served by the mobile branch.

From a safety standpoint, bankers with mobile units said they are loaded with security cameras and other measures to protect staff, the vehicle, and its contents. Local police typically are notified where and when mobile branches will be stationed.

In addition to the service a mobile branch can provide and the good will it generates among its customers, a branch on wheels also is a valuable marketing tool. Whether it shows up at a disaster site, a school, a community event, or a local parade, it presents the financial institution in a positive light as an involved corporate citizen.

PNC takes its mobile units to college campuses during move-in week, making it easier for new students to open accounts without having to find fixed branches.

The mobile branches get noticed.

“They’re billboards for us going down the road. We wrap them from head to toe,” said PNC’s Hill.

U.S. Bank’s Reier also said brand awareness is a side benefit of mobile branches.

“When it’s rolling down the road, of course, but more importantly when it arrives in town,” Reier said.

Paul Gores is a journalist who covered business news for the Milwaukee Journal Sentinel for 20 years.

By Lorenzo Cruz

By Lorenzo Cruz

By Rose Oswald Poels

By Rose Oswald Poels

By Rose Oswald Poels

By Rose Oswald Poels

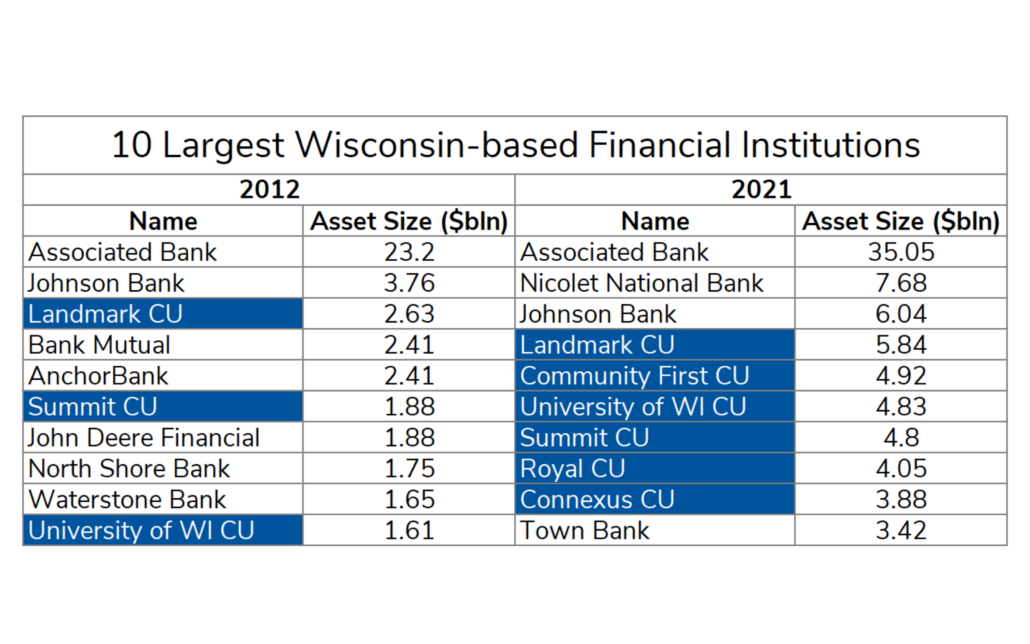

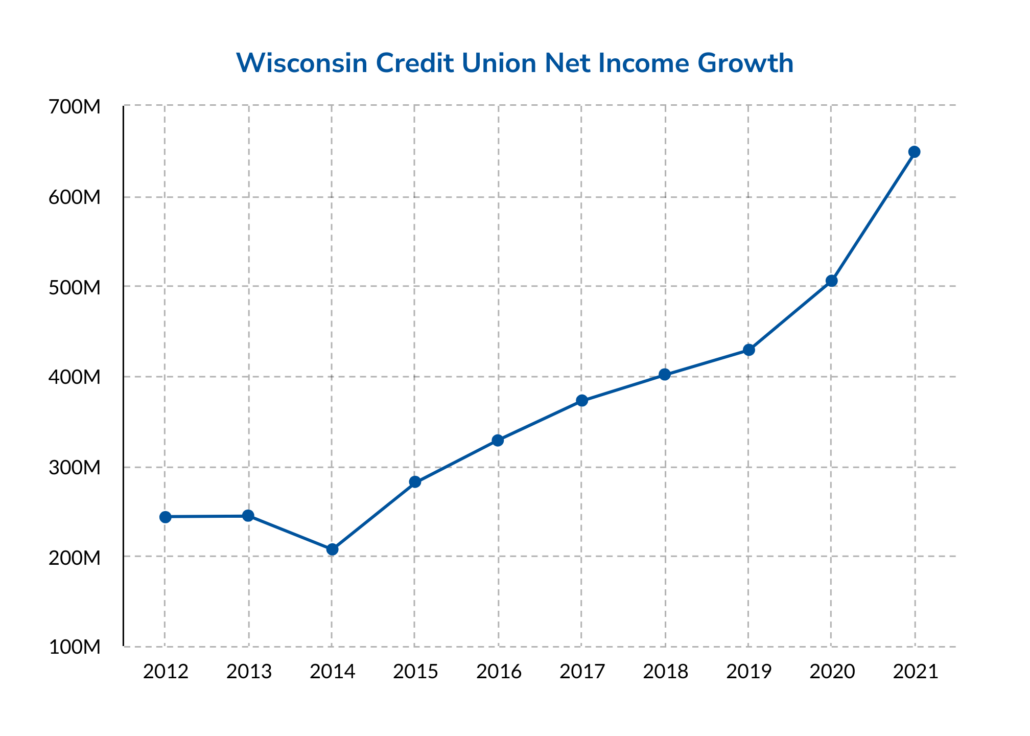

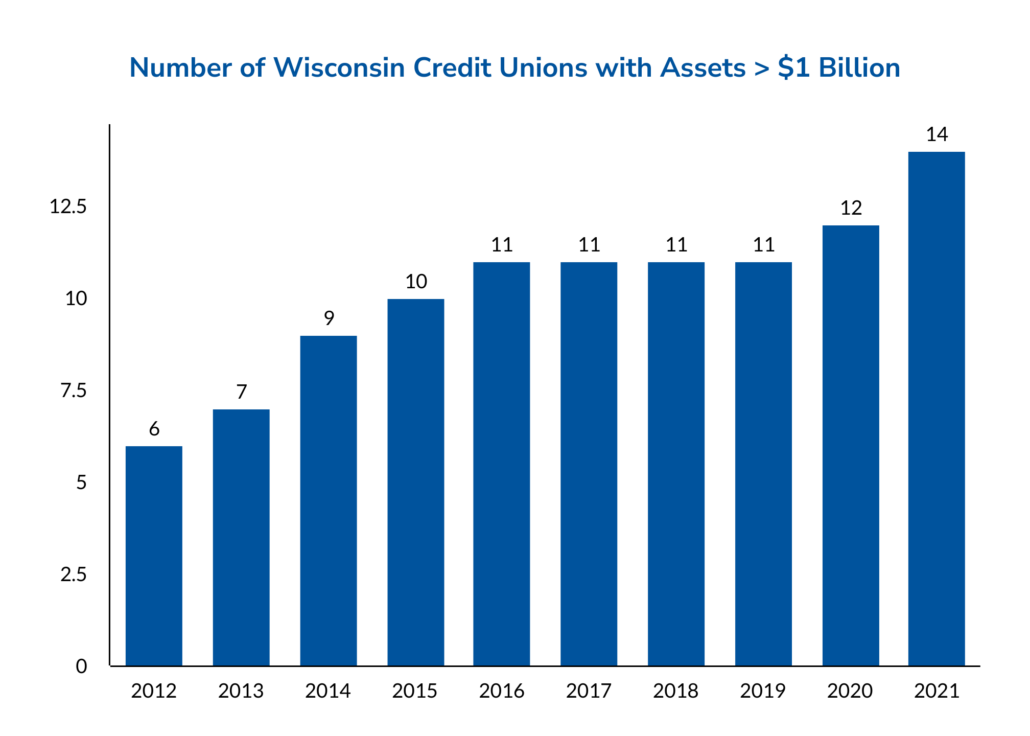

“Wisconsin is experiencing a disturbing trend of credit unions buying banks. These acquisitions result in a direct loss of tax revenue to the state and federal government which places more of the burden on individuals and taxpaying businesses to support meaningful government and social services such as law enforcement, health insurance for low-income families and their children, infrastructure, and education,” says Oswald Poels. “WBA repeatedly questions the public policy rationale for allowing these acquisitions to occur with state and federal lawmakers highlighting the detriment to our state every time one is announced.”

“Wisconsin is experiencing a disturbing trend of credit unions buying banks. These acquisitions result in a direct loss of tax revenue to the state and federal government which places more of the burden on individuals and taxpaying businesses to support meaningful government and social services such as law enforcement, health insurance for low-income families and their children, infrastructure, and education,” says Oswald Poels. “WBA repeatedly questions the public policy rationale for allowing these acquisitions to occur with state and federal lawmakers highlighting the detriment to our state every time one is announced.”

By Rose Oswald Poels

By Rose Oswald Poels