Over three years of connecting consumers to financial services and products

By Hannah Flanders

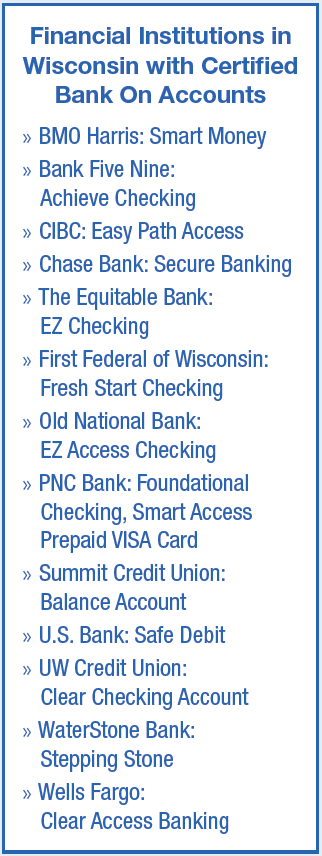

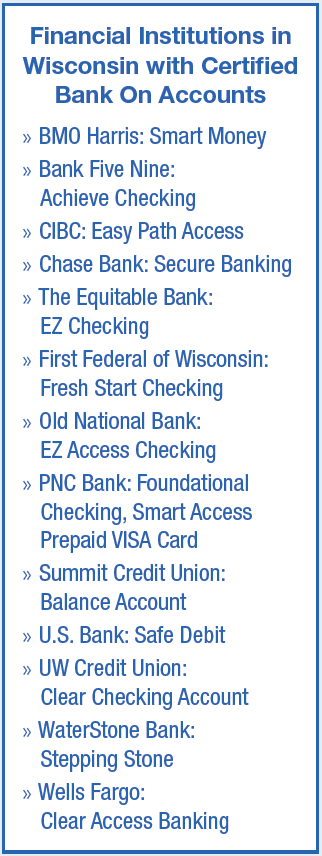

From youth to formerly incarcerated individuals reentering society, Bank On has helped in connecting thousands of underbanked individuals with financial services across the state. Since the launch in 2019, Bank On Greater Milwaukee — a local coalition of the national Bank On movement — has assisted more than a dozen financial institutions in certifying specific accounts that comply with the standards set by the Cities for Financial Empowerment Fund (CFE Fund).

From youth to formerly incarcerated individuals reentering society, Bank On has helped in connecting thousands of underbanked individuals with financial services across the state. Since the launch in 2019, Bank On Greater Milwaukee — a local coalition of the national Bank On movement — has assisted more than a dozen financial institutions in certifying specific accounts that comply with the standards set by the Cities for Financial Empowerment Fund (CFE Fund).

What is Bank On?

Across the country, Bank On has led financial institutions of all sizes to connect with individuals who lack a banking relationship. By identifying barriers to opening and sustaining healthy accounts, Bank On has not only connected more individuals than ever with banking services, but also helped promote safe and appropriate accounts in mainstream financial institutions. In the greater Milwaukee area, the Bank On initiative has specifically targeted its focus on local youth, first-time job seekers, and families with disabilities in gaining access to financial services.

“Our goal as an organization is to assist financial institutions in establishing the initial relationship with unbanked individuals,” states Constance Alberts, program director at Bank On Greater Milwaukee. “By laying the foundation for our community members to build wealth and reach their goals, these customers are able to move to the next level — taking out loans or mortgaging a new house. This first step builds confidence and trust — an important aspect of maintaining loyalty well into the future.”

In partnering with Bank On, banks have the opportunity to be advocates for underserved groups and the ability to connect them with the appropriate services and products for their unique situations.

Bank On’s Impact in Wisconsin

In October, the Federal Deposit Insurance Corporation (FDIC) released its biennial National Survey of Unbanked and Underbanked Households. The 2021 survey demonstrated a decrease throughout the country in unbanked individuals. In Wisconsin, the unbanked population represented only 2% of the over 5.8 million residents in the state.

This encouraging total is further underscored by the 4% decrease in unbanked individuals throughout the greater Milwaukee area since the previous survey in 2019.

As Bank On expands into the greater Milwaukee community — with numerous institutions offering products and accounts and even more institutions seeking certification — Cheryll Olson-Collins, secretary-designee of the Wisconsin Department of Financial Institutions (DFI), emphasizes the importance of financial soundness in Wisconsin’s communities.

“Being ‘banked’ isn’t just an adjective; it is, in fact, a critical component of financial stability. Having and using a basic checking account both facilitates critical everyday transactions, and at the same time provides a core foundation for other financial successes.”

Why Bank On?

With a mission to connect consumers to safe, affordable bank accounts, Bank On provides a unique opportunity for banks looking to support members of their communities.

“By joining the growing number of Bank On Greater Milwaukee partners, banks will engage with the community in new ways, reach new unbanked or underbanked customers and bring them into the financial mainstream while supporting Community Reinvestment Act (CRA) efforts,” highlights Olson- Collins. “Bank On partners play a critical role in making it possible for people to access the financial mainstream and spearheading a more inclusive financial system.”

Currently, Bank On Greater Milwaukee has 52 members, which include various community-based organizations, financial institutions, government partners, and network partners. Additionally, over 165 individuals are part of the coalition’s network.

Heather MacKinnon, WBA vice president – legal and member of the Bank On Greater Milwaukee leadership team, states that the connections made available through the coalition are one of the greatest resources available for bankers seeking to support their community — even if they are outside of Milwaukee County.

“It is impressive how the community participants and financial institutions involved with Bank On Greater Milwaukee work to connect persons with a need for safe, low-cost banking products with banks that offer a certified Bank On account,” she says. “It is a helpful tool for banks working on their diversity, equity, and inclusion (DEI) initiatives to partner with their local community groups working on similar missions of financial empowerment.”

How to Get Involved

While Wisconsin’s sole Bank On coalition is currently based in and only serves residents of Milwaukee County, banks throughout Wisconsin have the ability to get involved.

“With so much work to be done in granting unbanked individuals access [to safe financial services,] it is impossible to tackle alone,” said Alberts. “It is critical that financial institutions throughout the state acknowledge where there is a need for safe, affordable banking and promote what is good in their communities.”

In addition to connecting Milwaukee-area residents to certified, safe, and low-cost products, the Bank On Greater Milwaukee initiative aims to support consumer financial education throughout the state and assist financial institutions in recognizing the need in their communities.

Community involvement, according to Alberts, is a significant way that banks can begin serving the low- to moderate income members of their communities and is a pipeline for additional benefits for both the consumer and the financial institution. Bankers looking to get involved with Bank On Greater Milwaukee, learn more about the coalition, or certify an account with the CFE Fund should visit bankonmilwaukee.org.

By Dave Oldenburg

By Dave Oldenburg

A Graduate Profile of NaKecia Dean, Johnson Financial Group

A Graduate Profile of NaKecia Dean, Johnson Financial Group