Posts

Numbers released today by the Federal Deposit Insurance Corporation (FDIC) showed Wisconsin banks remained in a healthy position through the final quarter of 2023. Banks continued to meet the borrowing needs of their customers, as evidenced by year-over-year lending increases in all categories (commercial, residential, and farm loans). Deposits were up both quarter over quarter (1.12%) and year over year (2.00%), demonstrating public trust in Wisconsin banks as safe places to keep money. While net interest margin has decreased slightly from 3.27% to 3.20% year over year, capital levels are healthy.

Notable indicators include:

- Residential loans grew quarter over quarter (7.64%) and year over year (5.62%). With low inventory, homes continue to sell quickly. The Fed did not raise interest rates in the last quarter of 2023, and rates remain good in historical context.

- Commercial lending increased only slightly year over year (0.20%) and decreased slightly quarter over quarter (-0.60%) as business owners continue to monitor economic trends and interest rates.

- Farm loans increased year over year (10.30%) as farmers looked to upgrade equipment, make capital improvements, or expand. The decrease in farm loans quarter over quarter (-22.31%) reflects seasonal demand fluctuation.

- Past-due loans increased as inflation, the lag effect of interest rate hikes earlier in 2023, and slowed income growth presented challenges to borrowers in paying back their loans. Banks anticipated and were prepared for an increase in net charge-offs (loans that are unlikely to be repaid).

Statement on the release of fourth-quarter 2023 Federal Deposit Insurance Corporation (FDIC) numbers from Rose Oswald Poels, president and CEO of the Wisconsin Bankers Association:

“The year 2023 ended on a positive note with banks in a solid position. Residential loans are picking up, while many business owners are tending more toward a ‘wait-and-see’ approach on borrowing. Bankers, consumers, and business owners alike are hopeful that the Federal Reserve will lower interest rates in 2024. Inflation, the potential for a recession, and geopolitical issues remain top concerns for the year ahead. Wisconsin banks continuously evaluate economic conditions and stand ready to serve their customers and communities as trusted financial partners.”

FDIC-Reported Wisconsin Numbers (Dollar Figures in Thousands)

| 12/31/2023 | 9/30/2023 | QoQ Change | 12/31/2022 | YoY Change | |

| Net loans and leases | $109,763,200 | $111,536,925 | -1.59% | $105,370,783 | 4.17% |

| Total deposits | $122,411,348 | $121,056,967 | 1.12% | $120,013,372 | 2.00% |

| Commercial and industrial loans | $17,839,610 | $17,946,778 | -0.60% | $17,804,684 | 0.20% |

| Residential real estate loans | $33,839,052 | $31,436,804 | 7.64% | $32,038,691 | 5.62% |

| Farm loans | $4,031,270 | $5,188,674 | -22.31% | $3,746,971 | 7.59% |

| Total assets | $152,451,299 | $153,646,118 | -0.78% | $149,546,185 | 1.94% |

| Assets 90+ Days Past Due or in Nonaccrual Status | $542,817 | $518,570 | 4.68% | $411,481 | 31.92% |

Wisconsin Bankers Foundation Recognizes Outstanding Financial Education Initiative

The Wisconsin Bankers Foundation (WBF) is pleased to announce that National Exchange Bank & Trust, headquartered in Fond du Lac, Wis., has been selected as the recipient of the 2023 Financial Education Innovation Award. The award was presented to National Exchange Bank & Trust representative Jaclyn Rutkowski during a special luncheon on February 8, 2024, in Wisconsin Dells at the largest banking industry event in the state, the Wisconsin Bankers Association (WBA) Bank Executives Conference.

“Too often, people are reluctant to talk or ask questions about finances,” said Rose Oswald Poels, WBF chair and WBA president and CEO. “Through their ‘It’s OK not to know’ campaign, National Exchange Bank & Trust has shared useful financial resources in a fun, accessible way.”

National Exchange Bank & Trust representatives (left to right) Karri Oelke, Jaclyn Rutkowski, and Nicole Wiese

National Exchange Bank & Trust’s multi-media financial education campaign, titled “It’s OK not to know,” ran across digital and social media channels, including TikTok, Facebook, and Instagram. The campaign was designed to engage community members who may not yet feel confident in their financial literacy. Featured content covered topics such as “pay yourself first,” “zero-based budgeting,” and the difference between an adjustable-rate mortgage (ARM) and a fixed-rate mortgage. The campaign included a diverse range of media, such as short-form videos, images with text, emails, and blog posts. The shareable content also emphasized an overarching theme that banks are judgement-free resources, ready to provide support and guidance.

The WBF Financial Education Innovation Award is a prestigious category of the WBF Excellence in Financial Education Awards. Submissions for the 2023 WBF Excellence in Financial Education Awards encompassed over 700 financial education presentations given by 365 Wisconsin bank employees, reaching approximately 25,500 Wisconsin community members.

Federal Deposit Insurance Corporation (FDIC) data released today showed Wisconsin banks remained in good health through the third quarter of this year. Year-over-year lending increased in all categories (commercial, residential, and farm loans), demonstrating the responsiveness of banks to meet their customers’ needs. Individuals and businesses continue to trust banks as a safe place to keep their money, as evidenced by a slight increase in deposits, both year over year (0.59%) and quarter over quarter (0.95%). Net interest margin has held steady at 3.19% year over year, and capital levels are healthy.

Notable indicators include:

- Residential loans continued to grow, both year over year (25.19%) and quarter over quarter (15.38%). With low inventory, homes continue to sell quickly. Despite interest rate increases, rates remain relatively low in historical context.

- While commercial lending increased year over year (2.36%), it decreased slightly quarter over quarter (-1.61%), showing waning economic confidence of business owners.

- Farm loans increased both year over year (10.30%) and quarter over quarter (7.54%) as farmers looked to upgrade equipment, make capital improvements, or expand.

- Credit quality weakened as inflation, interest rate hikes, and slowed income growth have made it more difficult for borrowers to pay back their loans.

Statement on the release of third-quarter 2023 Federal Deposit Insurance Corporation (FDIC) numbers from Rose Oswald Poels, president and CEO of the Wisconsin Bankers Association:

“The newly released FDIC numbers showed that Wisconsin banks remained on solid footing through the third quarter of 2023. Banks continue to be trusted partners in helping individuals, families, and businesses meet their financial goals. As has been the case for several quarters — inflation, interest rates, and geopolitical issues remain concerns heading into 2024. Banks will continue to position themselves to support their communities through potential economic headwinds.”

FDIC-Reported Wisconsin Numbers (Dollar Figures in Thousands)

| 9/30/2023 | 6/30/2023 | QoQ Change | 9/30/2022 | YoY Change | |

| Net loans and leases | $111,535,045 | $109,975,599 | 1.42% | $103,954,503 | 7.29% |

| Total deposits | $121,056,968 | $119,920,909 | 0.95% | $120,347,373 | 0.59% |

| Commercial and industrial loans | $17,946,778 | $18,240,073 | -1.61% | $17,533,085 | 2.36% |

| Residential loans | $31,432,982 | $27,242,091 | 15.38% | $25,109,047 | 25.19% |

| Farm loans | $5,188,674 | $4,824,718 | 7.54% | $4,704,303 | 10.30% |

| Total assets | $153,648,227 | $152,380,455 | 0.83% | $148,567,421 | 3.42% |

| Assets 90+ Days Past Due or in Nonaccrual Status | $518,570 | $434,070 | 19.47% | $417,336 | 24.26% |

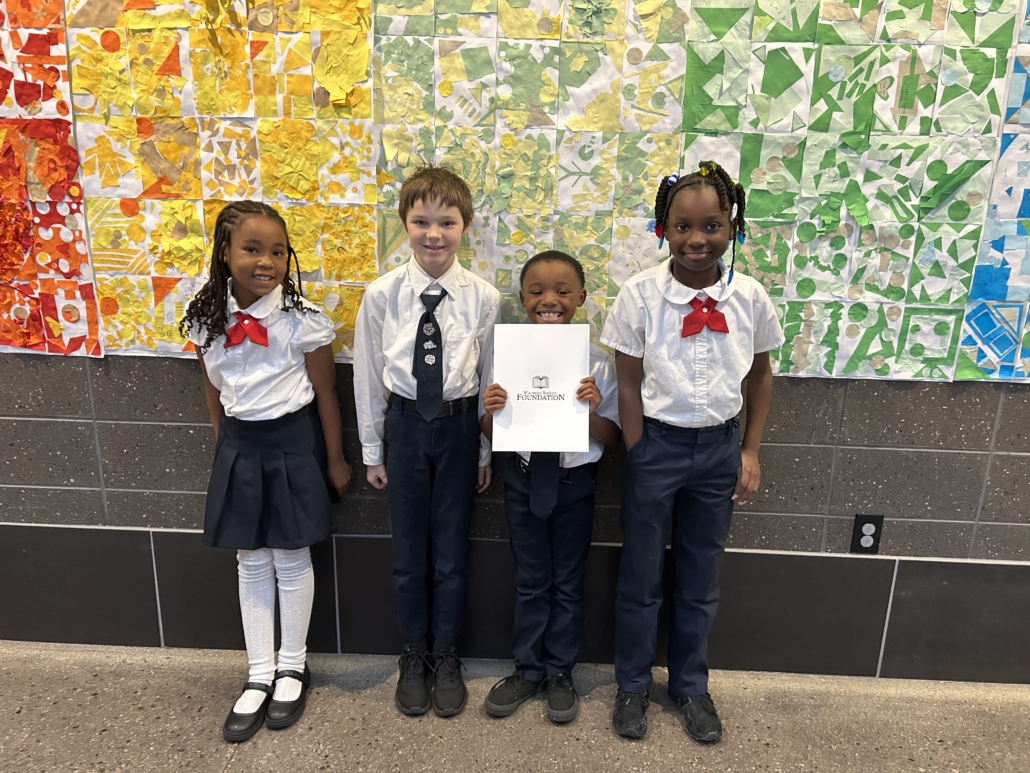

The Wisconsin Bankers Foundation, the non-profit arm of the Wisconsin Bankers Association, is pleased to announce a $5,000 grant to St. Marcus School in Milwaukee. The grant will support the St. Marcus community engagement team’s financial education efforts during the 2023–2024 school year, including:

- Virtual financial literacy classes hosted by St. Marcus and their community partner organizations.

- In-person “Rising Star” meetings. These dinner meetings spotlight a parent who shares a testimonial about their recent successes with a group of other parents. The group also troubleshoots obstacles that other parents are facing and creates a resource for each other.

- A recognition and celebration event called “RISE” (Resilient Individuals Seeking Excellence) that brings together school parents, staff, and community members who celebrate the successes of a group of 4–5 parents who are on their way to becoming homeowners, have become homeowners, or are accomplishing their financial goals in other ways.

“The work St. Marcus School’s community engagement team is doing to empower the families of their students aligns wonderfully with our Foundation’s mission to promote financial literacy and capability,” said Rose Oswald Poels, chair and treasurer of the Wisconsin Bankers Foundation. “We are proud to support these initiatives and congratulate the St. Marcus staff and participants on the positive impact they are creating.”

St. Marcus School is one of two recipients of a 2023–2024 Wisconsin Bankers Foundation grant. The Foundation also awarded a $5,000 grant as part of a three-year commitment to Asset Builders to support its statewide Finance and Investment Challenge Bowl for high school students.

Second-quarter 2023 data from the Federal Deposit Insurance Corporation (FDIC) show that Wisconsin banks remain on a solid foundation. Banks continue to be responsive to the needs of their customers, and lending increased in all categories (commercial, residential, and farm loans). Deposits also increased slightly as consumers and businesses remained confident in Wisconsin banks as a safe place to keep their money. Net interest margin remains strong at 3.24%, and capital levels are healthy.

Notable indicators include:

- Residential loans continued to grow, both year over year (14.19%) and quarter over quarter (3.26%). With low inventory, homes continue to sell quickly. Despite recent interest rate increases, rates remain relatively low in historical context.

- Commercial lending increased year over year (6.38%) and has picked up quarter over quarter (3.06%), showing increased confidence of business owners.

- Farm loans increased both year over year (8.50%) and quarter over quarter (26.16%).

- Credit quality weakened slightly as inflation and rising interest rates have made it more difficult for borrowers to pay back their loans.

- Deposits increased slightly over both the year and the quarter as inflation eases and consumers and businesses are able to save more.

Statement on the release of second-quarter 2023 Federal Deposit Insurance Corporation (FDIC) numbers from Rose Oswald Poels, president and CEO of the Wisconsin Bankers Association:

“In the second quarter of 2023, Wisconsin banks showed continued strength and profitability. Banks continue to meet the borrowing needs of individuals, families, and businesses. Deposits have held steady, and delinquencies remain low. While inflation, interest rates, and geopolitical issues remain concerns for the remainder of 2023, banks are prepared for future risks and are poised to support their communities through possible economic challenges.”

FDIC-Reported Wisconsin Numbers (Dollar Figures in Thousands)

| 6/30/2023 | 3/31/2023 | QoQ Change | 6/30/2022 | YoY Change | |

| Net loans and leases | $109,974,664 | $106,543,106 | 3.22% | $99,946,680 | 10.03% |

| Total deposits | $119,920,910 | $118,136,508 | 1.51% | $118,628,924 | 1.09% |

| Commercial and industrial loans | $18,241,734 | $17,700,465 | 3.06% | $17,147,615 | 6.38% |

| Residential loans | $27,242,091 | $26,381,632 | 3.26% | $23,857,546 | 14.19% |

| Farm loans | $4,824,718 | $3,824,265 | 26.16% | $4,446,588 | 8.50% |

| Total assets | $152,378,582 | $149,715,078 | 1.78% | $145,897,591 | 4.44% |

| Assets 90+ Days Past Due or in Nonaccrual Status | $433,555 | $406,287 | 6.71% | $430,201 | 0.78% |

By WBA President and CEO Rose Oswald Poels

In signing the state budget today, Governor Tony Evers supported a historic tax law change approved by the state Legislature that builds on the state’s success in attracting and investing in Wisconsin businesses. Beginning this year, the new law will promote further economic development by providing banks with an income tax exclusion on income earned from commercial loans for business or agricultural purposes of $5 million or less where the borrower resides, or is located, in the state of Wisconsin.

Ultimately, this state tax law change directly supports economic growth as Wisconsin banks continue to work with their Main Street small businesses and farmers. The Wisconsin Bankers Association wishes to thank Governor Evers and his Administration, Senate Majority Leader Devin LeMahieu, Speaker Robin Vos, Joint Finance Committee Co-Chairs Sen. Howard Marklein and Rep. Mark Born, and all Joint Finance Committee members, including Rep. Terry Katsma and Sens. Mary Felzkowski and Pat Testin, for their collective leadership in support of Wisconsin’s banking industry.