By Cassandra Krause

The wage gap, or the difference in earnings between different groups (most commonly women and men) — even in 2023 — continues to undermine the principles of fairness and equality in the workplace and society. The wage gap is compounded by the wealth gap, and the consequences on the economy and upward mobility can be far-reaching.

A Glance at the Numbers

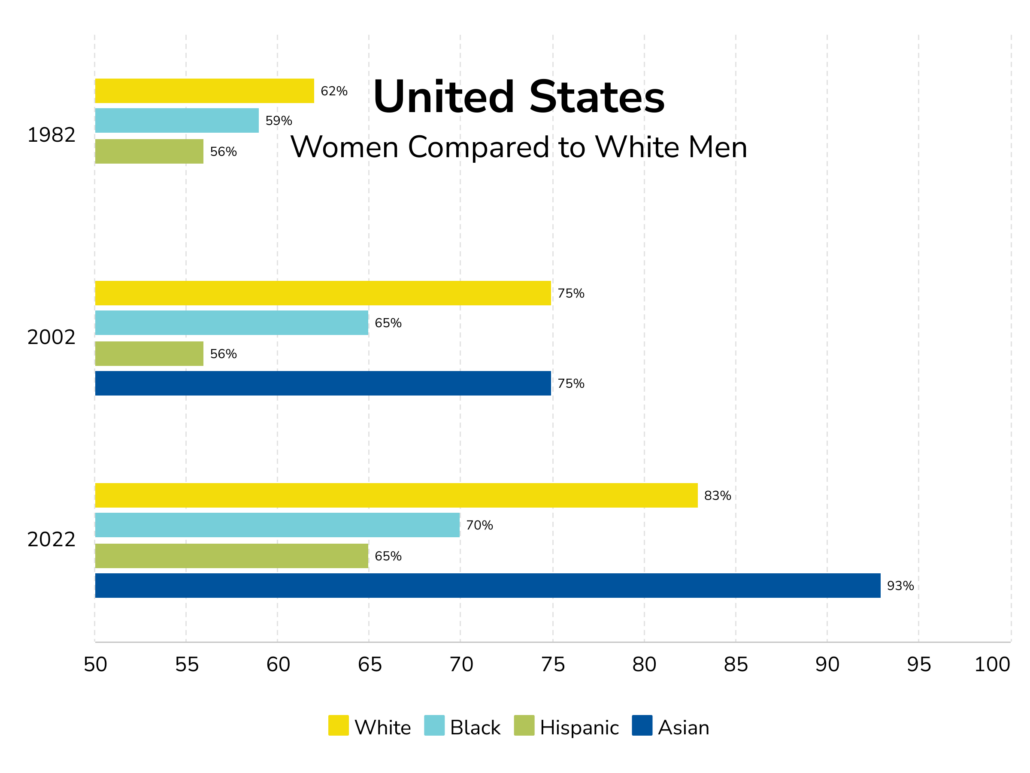

The gender pay gap in the U.S. has not budged much over the last two decades. According to the Pew Research Center, in 2022, American women typically earned 82 cents on the dollar compared to men, which was about the same as in 2002, when women earned 80 cents on the dollar. Jumping back two more decades to 1982, women earned only 65 cents on the dollar compared to men. To put the current stats into perspective, Equal Pay Day in 2023 (which marks how far into the new year women would have to work to earn what men earned in 2022) fell on March 14.

March 14, 2023: Equal Pay Day

The earnings gap does not only apply to gender; factors such as race, ethnicity, disability, or being part of the LGBTQ+ community also impact the gap. For example, in 2022, Black women earned just 70 cents on the dollar compared to white men and Hispanic women earned only 65 cents on the dollar, according to Pew Research Center data. Generally speaking, the more marginalized identities a person has, the likelier the wage gap is to widen.

Source for charts: Pew Research Center

What Accounts for the Gender Wage Gap?

As Wendy Baumann, president/CVO of the Wisconsin Women’s Business Initiative Corporation (WWBIC), puts it, “Sexism is alive and well.” She emphasizes that what employers are measuring matters, including the number of women in leadership and management roles, “If you have one or two women — or zero — on your board, in your C-suite, do you think that’s right?”

Baumann also serves on the steering committee of Milwaukee Women inc, a non-profit organization that was created in 2002 to change the face and quality of leadership in the Wisconsin business community. In their 2022 Research Report, Milwaukee Women inc celebrates 20 years of advancing inclusive leadership and noted that the percentage of Wisconsin public companies with three or more women directors increased from 6% in 2003 to 44% in 2022. In that same period, there was a six-fold increase in the number of newly elected women directors and 4.5-fold increase in the number of women of color directors at Wisconsin’s top 50 public companies.

While experts often — and rightfully so — focus attention on women in leadership roles, women at all stages of their careers in nearly all professions are paid, on average, less than their male peers. Women are also overrepresented in services occupations with lower pay and underrepresented in managerial and STEM occupations with higher pay and better benefits. While there is no one clear explanation for the gender pay gap, many point to factors such as women tending to have more unpaid caregiving responsibilities outside of work, bias in hiring and promotions, and a lack of opportunities for mentorship.

Inequality in Accumulated Resources

It is not only wages that are unequally distributed in the U.S., but wealth as well. Wealth includes assets such as real estate, savings, investments, and ownership of businesses. The wealth gap is fueled by the wage gap and influenced by other factors like intergenerational inheritance, access to quality education, and systemic barriers to accessing capital.

Building equity in a home and being able to transfer that wealth across generations is an important factor. U.S. Census Bureau data shows the homeownership rate in the U.S. at 66.0% in Q1 2023, with gaps exposed when the data is sliced by race and ethnicity: Black alone (45.8%); Hispanic (of any race) (49.7%); all other races (58.2%); Asian, Native Hawaiian, and Pacific Islander alone (61.6%); and non-Hispanic white alone (74.4%).

Furthermore, household portfolio composition and investment behavior play a significant role in the wealth gap. A 2019 Survey of Consumer Finances by the Federal Reserve showed that, on average, white households have a higher percentage of their wealth in stock equity than Black households. In a 2022 article published by the Federal Reserve Bank of Minneapolis, author Lisa Camnen McKay writes, “Housing has appreciated since the 1950s, but stock equity has appreciated five times as much. . . Now that income convergence has stalled, the difference in the capital gains rate experienced by Black and white households is the main factor pushing their wealth apart.”

Wealth inequality is significant because of wealth’s impact not only on an individual’s buying power, but its impact on a person’s quality of life, access to education and health care, retirement savings, and ability to set the next generation up for financial success.

The Role of Bankers in Closing the Gap

Bankers in Their Communities

Both in their roles as financial industry professionals and as community members, bankers can be part of the solution to the wage and wealth gap. Jason Fields, president and CEO of Madison Region Economic Partnership (MadREP) says, “If we’re looking at cutting the wealth gap in half — or eliminating it — then I think we have to attack this from a number of perspectives. . . you have to attack the trust issue, you have to attack the education issue, and then we have to really get into what tools and vehicles are there that can generate wealth.”

Fields, a former banker himself, encourages bankers to show up in person to community events to understand what underserved communities are going through and build relationships. He also notes the contributions bankers make in providing financial education. Providing financial education is both the right thing to do and is good for business. Fields says offering free trainings — and partnering with chambers, places of worship, etc. — can reach an untapped segment, “Because [some community members] don’t understand finances, because they don’t know who to trust, they never talk about it. . . When you have bankers showing that warm relationship, that will help feed the community to go ‘hey, here’s somebody I can trust that won’t make me feel like “less than” because I don’t know this stuff.'”

WWBIC is a statewide community development financial institution (CDFI) that focuses on individuals who face barriers in accessing traditional financing — in particular, women, people of color, veterans, rural, and lower wealth individuals. WWBIC also advocates for a holistic approach to closing gaps, encompassing relationships, education, and access to capital. WWBIC’s loan customers receive business coaching as part of their loan package. When it comes to lending, “banks don’t want to say ‘no,’ but they have their rules and regulations on what they can do in their box,” says WWBIC’s Baumann. “WWBIC’s box is bigger.”

Michael Hetzel, WWBIC statewide director of lending, points out that referring a customer to a CDFI is good for the bank because they preserve the relationship as a trusted advisor. The customer still needs the banking relationships for checking, deposit, merchant services, etc., and they may refinance the loan they received from a CDFI with the bank once they have built credit. “The banks do put their money where their mouth is,” says Hetzel, who was a banker for 25 years before joining WWBIC about a dozen years ago. “They help us help those people that maybe they can’t help.”

Bankers as Employers and Business Community Leaders

Banks can also play a role as employers in closing the gap. The 2022 Women in the Workplace report by McKinsey & Company, in partnership with LeanIn.org, draws attention to the “broken rung” at the first step up to manager. For every 100 men promoted to first-level manager at the end of 2021, 87 women overall and 82 women of color were promoted (note: numbers assume an equal number of men, women, and women of color at the entry level). In addition, a 2019 workplace and financial equality survey conducted by TD Bank revealed that over one-fifth (22%) of millennial workers feel that being out about their sexual orientation to more senior staff will hurt their career advancement.

The McKinsey report emphasizes the importance of flexible work and good managers, and listed key practices for driving progress toward gender equality:

- employee benefits,

- career development programs,

- data tracking, and

- trainings.

Baumann underscores that more awareness-building is necessary, beyond just observing Equal Pay Day. She points to formal and informal mentoring as important components for providing opportunity to employees who are underrepresented at senior levels. One example of rethinking mentoring would be if a company’s golf outing is primarily attended by men, then they should choose something else that is a more inclusive way for employees to network and gain mentors.

Looking Ahead

By raising awareness and increasing our understanding of wage and wealth gaps, we can help to bridge the divide. Bankers can take further steps to address bias and discrimination in their workplaces, continue to promote financial literacy in their communities, and grow partnerships with businesses and non-profit organizations to increase access to capital for underserved populations. In doing so, they will help to create a stronger and more prosperous future for all.

*WWBIC is a WBA Associate Member.