WBA’s Building Our Leaders of Tomorrow (BOLT)

By Cassandra Krause

If one thing is certain about young professionals in Wisconsin’s banking industry, it is that they are ambitious. Their careers mean more to them than just a paycheck, and they’re looking for ways to grow and make meaningful contributions. Nearly ten years ago, the Building Our Leaders of Tomorrow (BOLT) Section was created to tap into the potential of emerging leaders in banking across the state.

Julie Redfern was one of the inaugural BOLT Section Board members in 2013 and has advanced in her career to executive vice president, chief operations officer at Monona Bank. “Fostering growth and leadership skills in our industry was a motivational factor for joining the BOLT initiative in its infancy stages,” said Redfern. “We had a gap in our industry, and I think BOLT is now a great tool to offset that gap for bank CEOs looking to develop bench strength with future leaders at their community banks.”

Motivations for joining BOLT vary from banker to banker. Some are seeking opportunities to learn the skills needed to be a respected, contributing community banking officer able to handle increasing responsibility. Others join because of the access to a tremendous network of Wisconsin bankers with a vast back- ground of knowledge and experience who are willing to share it in a non-competitive environment. Still others may be looking to become more engaged in legislative, regulatory, and public affairs advocacy.

BOLT was launched to ensure ongoing success for community banks by focusing on talent development and providing networking opportunities for the next generation of community bank leaders to grow and develop the necessary skills to be effective leaders.

“Nearly a decade later, talent recruitment and retention, as well as succession planning, continue to be top concerns for community banks,” said Daryll Lund, WBA executive vice president and chief of staff. “We have grown to have over 500 BOLT Section members representing over 135 banks.” It is free for WBA members to join the BOLT section, so many banks take advantage of the opportunity to sign up multiple employees.

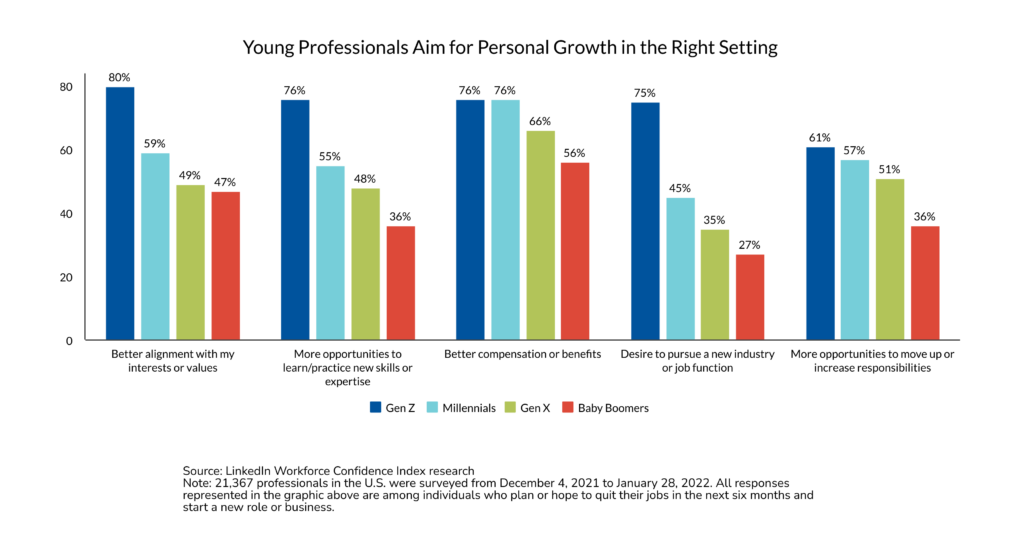

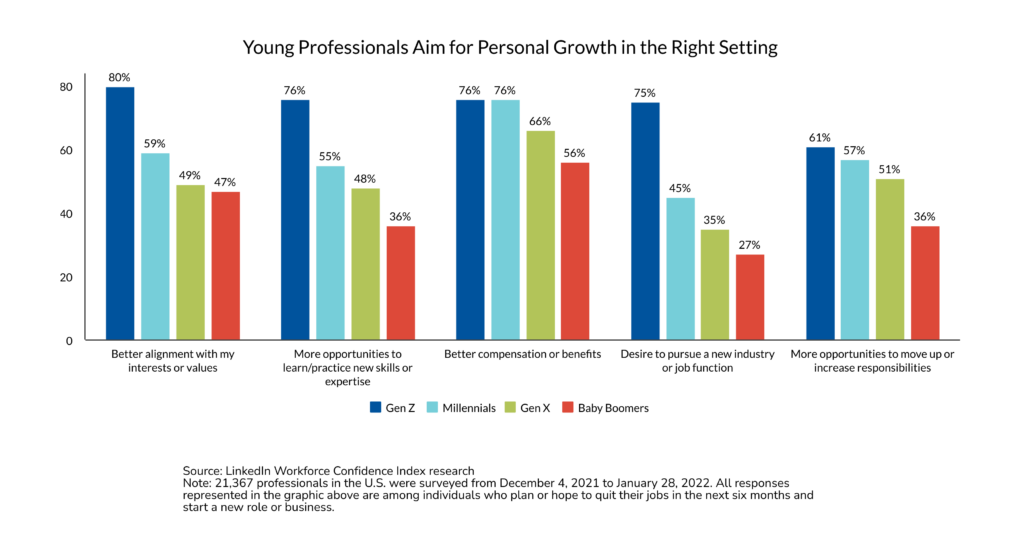

The Deloitte Global 2022 Gen Z and Millennial Survey found that approximately 40% of Gen Zers and 24% of millennials would like to leave their jobs within two years, and about a third would quit without another job lined up. While those numbers may be startling, a recent LinkedIn Workforce Confidence Index gives some insight into the priorities of job seekers.

As the chart above shows, a career path that aligns with the employee’s interests or values (80%) and more opportunities to learn/practice new skills or expertise (76%) are equally important to — or even more important than — better compensation or benefits (76%) for Gen Zers. Younger employees’ desire to pursue a new industry or job function and interest in moving up or increasing responsibilities underscore the importance of offering professional development opportunities.

A major draw to the BOLT Section is the access to the biannual BOLT Leadership Summits. Attendees often talk about the “spark” that’s ignited in them through the Summit programming and networking. Dan Ravenscroft was the inaugural BOLT Section Board chair and has since become president and CEO of Royal Bank, Elroy and continues his service to the industry on the WBA Board of Directors. “BOLT is designed to provide bankers with the additional knowledge, skills, and tools that they need to take their careers to the next level,” said Ravenscroft. “The connections, experiences, and relationships built through participation in the interactive BOLT Leadership Summits have proven invaluable in my personal career development.”

Lori Kalscheuer, WBA director – education, serves as the staff liaison to the BOLT Section Board and heads up the planning for the Summits. “The energy at the BOLT Summits is always very high, and the participants are eager to make the most of their experience,” said Kalscheuer. “Along with new skills and ideas, they bring back a lot of enthusiasm to their banks.” Kalscheuer emphasizes that leadership skills are applicable to any employee at the bank, regardless of job function, age, or experience level. She encourages any banker who wants to build their leadership skills to get involved with BOLT.

Now almost a decade in, the BOLT program sees continued engagement of longtime participants as well as many referrals for fellow bankers to get involved. Jennifer Sobotta, vice president and marketing director at Forward Bank, Marshfield, and current BOLT Section Board chair, views BOLT as an important benefit of WBA membership. “Joining the BOLT Section Board gave me an opportunity to stay connected with industry peers and the WBA,” explains Sobotta. “Being part of this group fits beautifully with the leadership initiatives we have going on at Forward Bank and has allowed me to identify and send our up-and-coming leaders on to fine tune their skills.”

As Loni Meiborg, senior vice president and director of organizational development, Fortifi Bank, Berlin rounds out her time on the BOLT Section Board as past chair, she has sought out a new opportunity to stay involved and continue to grow her career by serving on the WBA Marketing Committee. Her testimonial speaks for itself:

Without BOLT, I can honestly say I wouldn’t be where I am today in my career. Early on, the Summits allowed me to meet influential people who shared their knowledge and experience to help me grow. Once joining the BOLT Section Board, I was inspired by each member’s passion and commitment to fostering success among bankers and the industry overall. And now as past chair, I reflect on all the folks I’ve met and the speakers I’ve heard along the way, which have left their indelible mark on how I lead, how I think, and how I feel about banking. Thank you to the WBA leadership and team for focusing on, and knowing the importance of, Building Our Leaders of Tomorrow.

To learn more about BOLT, visit wisbank.com/BOLT.

By Rose Oswald Poels

By Rose Oswald Poels

By Jennifer Sobotta

By Jennifer Sobotta Having a CEO like Bill and a CFO like Rob willing to feature in an article like this is special. What is even more special is that they did dress as Clark and Cousin Eddie for an entire community to witness during a holiday parade. They approached those characters with wild abandon, and the joy and laughter they brought to the team fueled stories for years!

Having a CEO like Bill and a CFO like Rob willing to feature in an article like this is special. What is even more special is that they did dress as Clark and Cousin Eddie for an entire community to witness during a holiday parade. They approached those characters with wild abandon, and the joy and laughter they brought to the team fueled stories for years!

By Tisha Kenfield

By Tisha Kenfield

By Landon Turner

By Landon Turner

By Daryll Lund

By Daryll Lund By Rose Oswald Poels

By Rose Oswald Poels

Meredith Strieff describes herself as an accidental banker. In the over 15 years Strieff has worked at Horicon Bank, beginning as a part-time teller in 2007, she has worked her way through the ranks to her current role as vice president – retail branch & sales training, where she manages several teams of retail trainers and virtual bankers. Recently, she also completed her first year at the University of Wisconsin – Madison’s Graduate School of Banking.

Meredith Strieff describes herself as an accidental banker. In the over 15 years Strieff has worked at Horicon Bank, beginning as a part-time teller in 2007, she has worked her way through the ranks to her current role as vice president – retail branch & sales training, where she manages several teams of retail trainers and virtual bankers. Recently, she also completed her first year at the University of Wisconsin – Madison’s Graduate School of Banking.