Ag bankers reflect on 2023; prepare for the year ahead

By Hannah Flanders

Agricultural bankers in Wisconsin described 2023 as a year of highs and lows. As expected, it was difficult for Wisconsin farmers to beat the success of the last several years.

In 2021, farmers in Wisconsin were well-positioned for success. Ideal conditions for growing, increased receipts across the board, and lower expenditures than the national average set the stage for record profits in 2022. However, as 2023 unfolded, so too did a number of challenges causing farmers across the state to feel the pressure.

“There were times earlier in the year that I was certainly feeling more like a therapist than a banker,” notes Kevin Konkol, vice president – agricultural/business banking at First State Bank in New London. “However, agriculture runs in cycles. Farmers are aware that every one or two good years are followed by several years of headwinds; that’s where we’re at right now.”

Across the state, ag bankers are still seeing the strength carried over from the last several years, but deterioration is expected into the new year as farmers slowly begin pulling back.

One of the primary challenges that loomed large was the surge in interest rates, which reached over 500 basis points. Though relatively close to the historic average of between 6% and 7%, ag bankers note that many younger-generation farmers are experiencing sticker shock.

“Much of the older generation of farmers have seen rates hit 18% or 19%,” highlights Konkol. “This generation, on the other hand, has never seen prices so high.”

Jenny Jereczek, Security Financial Bank – Durand market president and director of ag banking, notes that while local farmers are cautious but optimistic for the year ahead, how rates will continue into the new year is the question on everyone’s mind. “When the U.S. dollar rises in value, our commodity prices and exports decrease. Coming off several great years, farmers still have relatively strong balance sheets but are seeking new ways to optimize and retain their margins in times of uncertainty.”

It’s up in the air whether current rates are here to stay. . . at least for the foreseeable future. In September 2023, the New York Times reported that Fed officials believed that rate hikes were close to the end and that the economy has seemed to settle into its long-term trajectory.

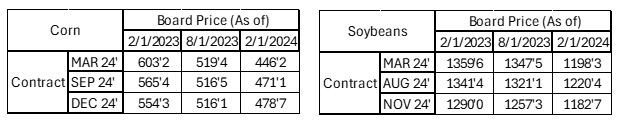

Whatever the prediction, ag bankers note that commodity prices remain a top concern for many farmers looking ahead.

This year, milk prices dropped from near-record levels to below $14 per hundredweight but have slightly rebounded since the summer. Compared to last year’s average of nearly $7 per bushel of corn, farmers saw prices hovering around the $5 mark.

However, a record-breaking 18% increase in cattle and beef prices from the year prior is expected to offset some of the headache.

“The main concern I’m hearing from farmers is cash flow; they’re all wondering where it will come from,” says Bank of Brodhead’s Assistant Vice President – Ag and Commercial Lending Adam Sommer.

Cody Kirschbaum, vice president – ag relationship manager at Peoples State Bank, Prairie du Chien, elaborates, “As term loans and operating lines of credit come upon renewal, many are experiencing the cost to borrow nearly doubling compared to 2022. This is expected to significantly affect the cash flow of an operation.”

The U.S. Department of Agriculture forecasts that net farm income will decrease by nearly 23% from the year prior. This alarming projection comes just as the cost to borrow increases and production expenses are forecasted to surpass a staggering $458 Billion.

In an effort for Wisconsin farmers to sustain the longevity of their farms, ag bankers each suggest that farmers, in partnership with their lenders, should closely monitor trends in foreign trade and input costs that often dictate U.S. market movements.

“In the last several years, farmers have gotten better at budgeting and understanding how they are able to mitigate risk to retain their margin. By following current events, farmers are able to create a game plan, and with the help of their lender, stick to it. In a volatile market, opportunities — whether it be diversifying or risk mitigations tools — are still available,” notes Jereczek.

However, it is important that producers utilize available resources and tools to help make the best educated decision possible for their specific operation.

“One size doesn’t necessarily fit all, so the playbook may look a bit different from farm to farm depending on the operation,” states Kirschbaum.

Unlike many areas where farmers are experiencing a decrease in returns, experts point out that farmland values throughout the Midwest — including Wisconsin — have remained robust. According to the Federal Reserve Bank of Chicago, farmland values in Wisconsin increased by 8% since 2022, reflecting the strong financial conditions of the past few years.

Of course, being in Wisconsin, weather conditions also played a pivotal role for farmers this year. More than 80% of Wisconsin experienced moderate to severe drought conditions right at the start of the 2023 growing season.

“Farms in the area are doing well considering the spotty rain we encountered this year,” notes Jereczek. “However, final yields for the fall harvest are yet to be determined.”

With the ongoing conflict in Ukraine — a major grain exporter — and the probability of droughts across the U.S. impacting crop yields, lower supplies are expected to impact the availability and cost of feed as well as exports abroad.

Like most sectors, the ag community is also concerned with consolidation, rapid innovation, and generational transitions.

“For many, this last year has really emphasized what variables we should be paying attention to moving forward, alongside the importance of risk mitigation and margin management,” highlights Kirschbaum. “In a quickly evolving economy and society, ag bankers need to be prepared. As trusted advisors and confidants, our role is to help our clients prepare for both the expected and the unexpected.”

The last several years have been a rollercoaster for Wisconsin’s agricultural sector, but experts agree that farmers throughout the state are well-prepared to tackle the uncertainties and opportunities that lie ahead.

“They’re a resilient bunch,” emphasized Sommer.

The following is a brief interview with Craig Rogan, vice president – agricultural banking officer at Nicolet National Bank in Stevens Point. Rogan is chair of the 2023–2024

The following is a brief interview with Craig Rogan, vice president – agricultural banking officer at Nicolet National Bank in Stevens Point. Rogan is chair of the 2023–2024

By Lance Lansing

By Lance Lansing

By Chris Schneider

By Chris Schneider

By Nicholas Felder

By Nicholas Felder

By Steven Thomas, BMO

By Steven Thomas, BMO