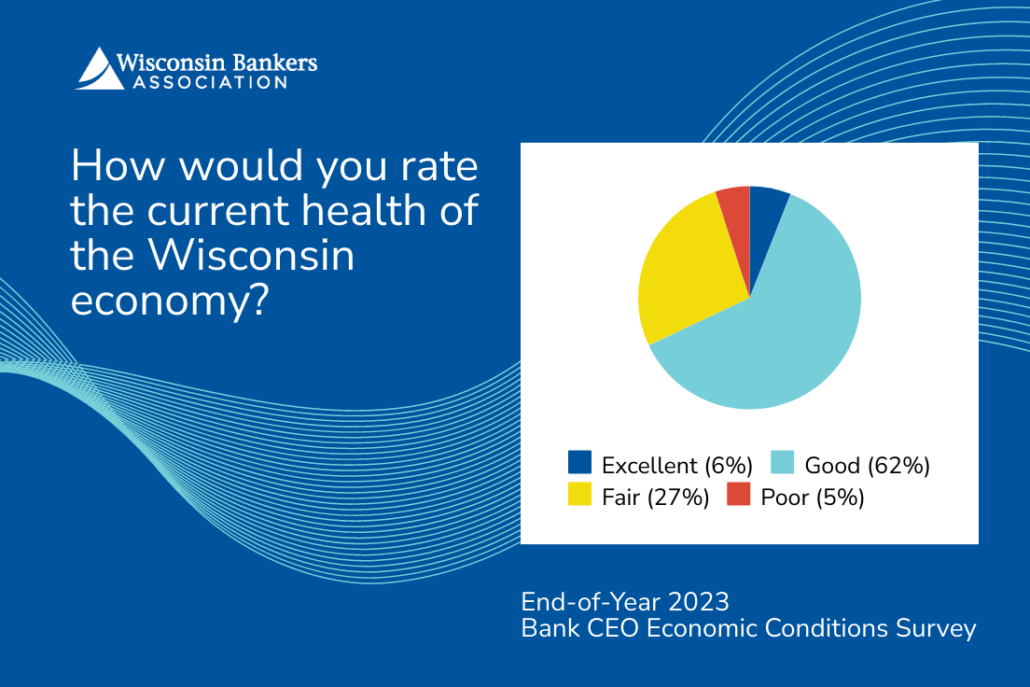

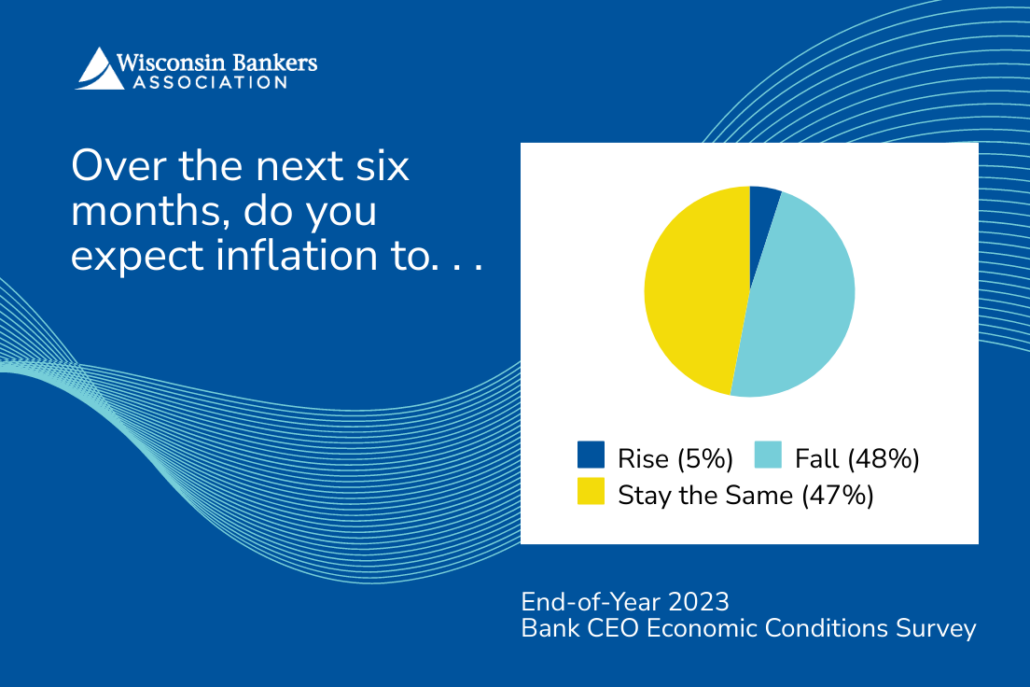

In the Wisconsin Bankers Association’s latest Economic Conditions Survey of Wisconsin bank CEOs, 68% of respondents rated Wisconsin’s current economic health as “excellent” or “good.” While most respondents (95%) do not foresee inflation worsening, 44% predict that the economy will weaken over the next six months and 47% predict it will stay about the same over the next six months. At the close of 2022, 72% of respondents predicted the economy would weaken over the next six months and 28% predicted it would stay about the same, showing some easing of economic concerns at 2023 year-end.

“Bankers have unique insights into their customers’ financial health as well as understand issues facing businesses in their markets,” said WBA President and CEO Rose Oswald Poels. “With continued headwinds in sight for the beginning of 2024, banks in Wisconsin stand prepared to support their communities.”

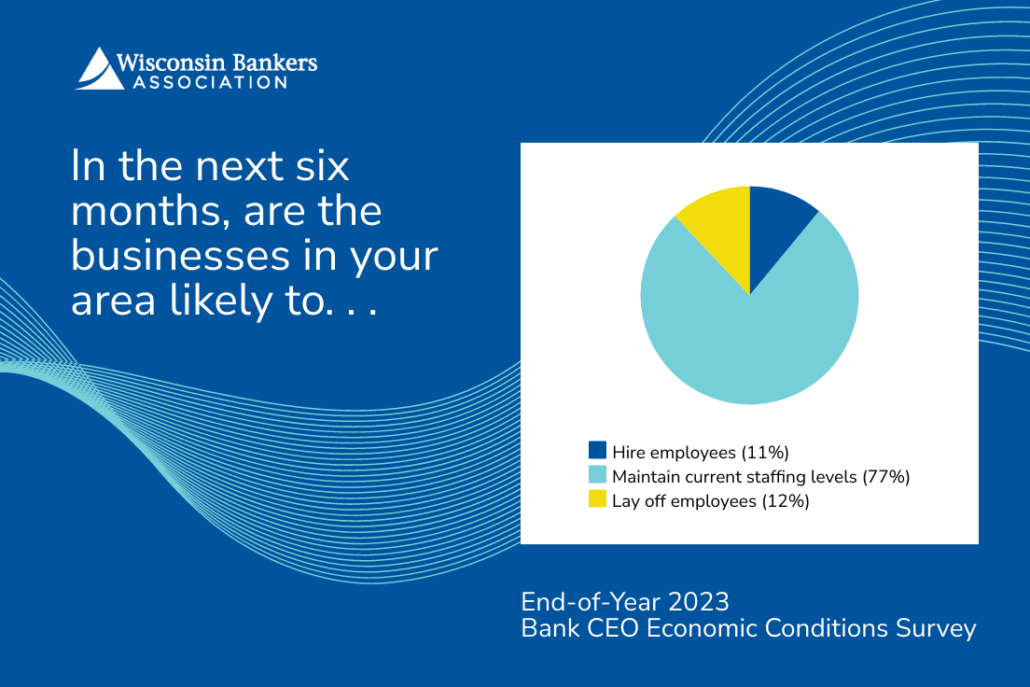

Among the economic bright spots cited by bank CEOs in the survey were low unemployment, profitability of area businesses — particularly in construction and manufacturing — and relatively good commodity prices for the agricultural industry. On the other hand, bank CEOs reported staffing and interest rates as top concerns of their business customers heading into the new year. The survey also showed inflation, a high cost of living, and availability and affordability of housing as top concerns for individuals and families for 2024.

The end-of-year 2023 survey was conducted November 14–29 with 66 respondents. Below is a breakdown of the survey questions and responses. Sums may not equal 100 percent due to rounding.

Wisconsin Bank CEO Economic Conditions Survey Results

| End-of-Year 2023 | Mid-Year 2023 | End-of-Year 2022 | |

| How would you rate the current health of the Wisconsin economy. . . | |||

| Excellent | 6% | 5% | 6% |

| Good | 62% | 68% | 69% |

| Fair | 27% | 27% | 24% |

| Poor | 5% | 0% | 1% |

| In the next six months, do you expect the Wisconsin economy to. . . | |||

| Grow | 9% | 0% | 0% |

| Weaken | 44% | 48% | 72% |

| Stay the same | 47% | 52% | 28% |

| Over the next six months, do you expect inflation to. . . | |||

| Rise | 5% | 14% | 24% |

| Fall | 48% | 44% | 51% |

| Stay about the same | 47% | 42% | 25% |

| How likely would you say a recession is in the next six months? | |||

| Very unlikely | 3% | 0% | 0% |

| Unlikely | 18% | 5% | 3% |

| Neutral | 38% | 24% | 10% |

| Likely | 32% | 56% | 62% |

| Very likely | 9% | 15% | 25% |

| Rate the current demand in the following categories: | |||

| Business Loans | |||

| Excellent | 5% | 6% | 3% |

| Good | 36% | 44% | 44% |

| Fair | 52% | 48% | 46% |

| Poor | 8% | 2% | 7% |

| Commercial Real Estate Loans | |||

| Excellent | 9% | 11% | 6% |

| Good | 30% | 33% | 34% |

| Fair | 48% | 50% | 53% |

| Poor | 12% | 6% | 7% |

| Residential Real Estate Loans | |||

| Excellent | 0% | 5% | 4% |

| Good | 13% | 14% | 7% |

| Fair | 28% | 50% | 33% |

| Poor | 59% | 31% | 55% |

| Agricultural Loans | |||

| Excellent | 2% | 0% | 3% |

| Good | 18% | 41% | 23% |

| Fair | 67% | 50% | 60% |

| Poor | 14% | 9% | 13% |

| Deposit | |||

| Excellent | 2% | 3% | 3% |

| Good | 18% | 17% | 44% |

| Fair | 56% | 58% | 44% |

| Poor | 24% | 23% | 9% |

| In the next six months, do you anticipate the demand for the following categories will. . . | |||

| Business Loans | |||

| Grow | 14% | 6% | 8% |

| Weaken | 35% | 50% | 56% |

| Stay the same | 52% | 44% | 35% |

| Commercial Real Estate Loans | |||

| Grow | 9% | 9% | 1% |

| Weaken | 41% | 56% | 63% |

| Stay the same | 50% | 35% | 35% |

| Residential Real Estate Loans | |||

| Grow | 20% | 13% | 6% |

| Weaken | 20% | 25% | 54% |

| Stay the same | 59% | 62% | 41% |

| Agricultural Loans | |||

| Grow | 9% | 12% | 15% |

| Weaken | 21% | 32% | 38% |

| Stay the same | 70% | 56% | 48% |

| Deposit | |||

| Grow | 17% | 17% | 13% |

| Weaken | 20% | 31% | 38% |

| Stay the same | 64% | 52% | 49% |

| In the next six months, are the businesses in your bank’s market area likely to. . . | |||

| Hire employees | 11% | 25% | 17% |

| Maintain current staffing levels | 77% | 69% | 71% |

| Lay off employees | 12% | 6% | 11% |

| In the next six months, is your bank likely to. . . | |||

| Hire employees | 29% | 23% | 23% |

| Maintain current staffing levels | 67% | 74% | 73% |

| Lay off employees | 5% | 3% | 4% |