By Chris Schneider, Nicolet National Bank

By Chris Schneider, Nicolet National Bank

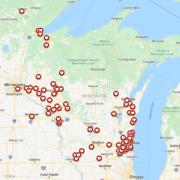

How nice it was to finally get together again as a group after two years of modified delivery of our annual WBA Agricultural Bankers Conference. The long-awaited return of the fully in-person conference was marked with great attendance, over 160 attendees including 130 bankers from across the state.

Always a highly-rated presenter, Eric Snodgrass, Science Fellow from Nutrien Ag Solutions, provided a detailed presentation on weather patterns and his prediction for this year’s weather forecast and the impact on crops in certain regions of the country. His long range predictions have been very accurate in past years. One of his topics that I found particularly of interest was the impact of Hurricane Ida on the supply chain.

Next up, Dr. Chad Hart, Iowa State University, took the stage and discussed marketing and risk management. He addressed many topics including the overall production of corn, beans, and wheat, and how the shifting of acres planted is impacted by certain factors; the Ukraine crisis and how that will affect global markets and shift exporting countries with commodities that come from them; and higher priced corn and the effects on exports. He also outlined how input cost and availability issues have increased cost dramatically and how that impacts if/when farmers can get products.

Wilson Law Group’s Daniel Purtell presented on estate planning brought out a lot of questions from conference attendees. Plan, Plan & Plan was the theme. We all know how most farmers like to plan, most are “reactive” folks. Don’t leave Ralph, the farmer’s son who was an underachiever his whole life, the farm because he will lose it. It’s never too early to plan for the next

generation.

Mike North from Ever.Ag was up next with marketing ideas for all commodities. He discussed marketing protection products and how they use these different types of items to protect milk, feed, and other items, sharing that less fluid milk and more cheese is what drives Wisconsin dairy plants. Cheese use increases on a yearly basis and is consumed in a variety of foods. The effects of European markets reducing production will help our country with driving more exports.

Ed Elfmann updated attendees on ABA’s priorities in Washington; from covering all the seats that are changing to policy updates. CFPB 1071 Rule, Farm debt declines at the end of 2020 somewhat due to additional government money, net farm income increasing, payments to farmers decline in 2021. The farm size has also changed; 9% of farms account for 33% of assets and 89% of farms are small but hold 60% of assets. Issues that should be top of mind for ag bankers include the Farm Bill hearings, as the current bill will expire in 2023; ECORA legislation; Farm Credit issues and the leveling of the playing field for banks vs Farm Credit; and RNG and Carbon credits and how this is getting driven into new income opportunities for farmers.

WBA’s John Cronin provided the Wisconsin update, covering the state budget and future policy discussions; shared what seats are up in the Wisconsin state assembly; and shared the budget and rule making process going forward.

AMPI was represented by their CEO and Co-President Sheryl Meshke. She talked about their markets and different facilities. AMPI is Co-op owned by farmers in multiple states and highlighted 50 plus years in business, producing award-winning products. Sheryl highlighted products including Dinner Bell Creamery, Co-op Crafted Promise, and Crystal Farm cheese. She expanded on how AMPI monitors the markets to stabilize and build business with their products.

Lastly Penn Vieau, a leadership expert, provided how to positively look at day to day activities. Have a positive mindset, positive thoughts, practice gratitude with purpose. Control, Influence, Accept. Attendees were encouraged to create goals that create new drive and energy, and importantly, goals that are achievable.

If you were unable to join us for this year’s annual conference, I hope that you will consider joining us in 2023. Watch for the 2023 conference dates to be announced soon to the Ag Section membership.

Chris Schneider is the current chair of the WBA Agricultural Bankers Section Board of Directors and is the vice president, agricultural banking with Nicolet National Bank in Appleton.

By Rose Oswald Poels

By Rose Oswald Poels

First State Bank recently announced the promotion of Brian Wood to vice president – loan operations. In his new role, Wood will oversee all aspects of application, processing, and servicing of First State Bank’s loan portfolio while ensuring adherence to loan policy and regulatory compliance.

First State Bank recently announced the promotion of Brian Wood to vice president – loan operations. In his new role, Wood will oversee all aspects of application, processing, and servicing of First State Bank’s loan portfolio while ensuring adherence to loan policy and regulatory compliance.