Archive for month: June, 2022

By Rose Oswald Poels

By Rose Oswald Poels

I am pleased to share that WBA’s new employee resource group (ERG) for bankers from underrepresented backgrounds in the industry is off to a successful start. About 25 bankers participated in the initial meeting in mid-June, and bankers continue to sign up to join the group. This is a wonderful opportunity for bank leaders to share with employees within their organization as a way to connect with other bankers from around the state. The next monthly meeting will take place virtually on Wednesday, July 27 from 1:00–2:00 p.m.

A few days after the first meeting of the ERG, WBA hosted a webinar led by Alonzo Kelly on the topic of creating a culture where everyone feels they belong. It is very clear that expectations of today’s workplace go far beyond just job duties, and team members do not simply check their personal lives and unique identities at the door when they arrive at work. It is important for staff not only to feel supported by their colleagues, but also to find others whose experiences resonate with their own.

The conversation took off right away at the first meeting of the ERG. It was evident that bankers were eager to find a forum like this to have a safe space to share their concerns and ideas, as well as to receive advice and actionable tools that they can bring back to their organization. We know that many small community banks would not be able to offer this type of employee benefit on their own — and that employees from larger banks also appreciate being able to connect with bankers outside their organization — so this is an area where WBA can play a helpful role.

The WBA Board of Directors formalized a Diversity, Equity, and Inclusion (DEI) plan about two years ago, and this new employee resource group is one of the many ways the plan is being carried out. This group is designed to be an inclusive space for members of the Black, Indigenous, and People of Color (BIPOC); LGBTQ+, persons with disabilities, religious minority communities, and veterans as well as anyone who has an identity that is underrepresented in the banking community. If you have not yet done so (or if you would like to send a reminder of the opportunity), I would highly encourage bank leaders and HR professionals to extend this invitation to the staff in your organization who could benefit from it. Bankers can sign up here for the ERG, and they will receive a calendar invite to the upcoming meeting on July 27.

If you would like to learn more about the DEI resources offered by WBA — including the WBA Connect DEI peer group, the bank DEI sample policy, and more — please visit the DEI page on our website and reach out to any of the contacts listed on that page if you have questions. Thank you for your continued participation in making Wisconsin’s banking industry a welcoming space for everyone who is employed at and does business with our institutions!

By Scott Birrenkott

Q: Can a Customer Open a Campaign Finance Account?

A: Yes. Customers may seek to open campaign accounts, political action accounts, conduit funds, and other types of election-related accounts.

Because there is no list of specific documentation that banks must collect for such accounts, banks receiving requests to open these accounts will need to consider what should be collected based upon policy and procedure. As there can be many types of campaign and election-related accounts, there is no one-size-fits-all approach. Banks will need to have a conversation with their customers to better understand the nature of the account requested. This article will use a state-related campaign as an example to illustrate an approach bank might take.

State-related campaigns must follow Wisconsin campaign and election laws. For example, a customer might run for mayor, or sheriff, and seek an account to maintain their campaign funding. The documentation the customer might have, and what documentation the bank might collect from the customer depends upon how the customer is holding funds, making contributions, disbursements, and fundraising. For this reason, the bank should consider having a conversation with the customer to better understand the campaign and use that information to gather any supporting documentation for confirmation of those details.

Bankers might also consider familiarizing themselves with the election process. Particularly if these accounts become common. It is not necessary to become an expert on Wisconsin campaign finance law, but familiarization with the process will go a long way in facilitating easier conversations with customers, knowing the right questions to ask, and to better request relevant information to maintain the account. For example, restrictions or reporting requirements might apply, depending on the campaign. While such requirements are generally the duty of a campaign’s treasurer to follow, from a “know-your-customer” perspective it is worth the bank taking the time to understand these details.

An example account title for such an account would be: John Doe for Sheriff by Jane Doe as Treasurer.

The law of campaign finance is complex. Furthermore, a customer might seek to open an account different than that used in the example above (ex: PAC, conduit, or federal election). Based upon this complexity and variety, a financial institution should also consider seeking assistance from its legal counsel in opening and maintaining such accounts.

Pictured left to right are: Dawanda Street, Darnesha Wilson, Evan Taylor, Nayeli Rocha, and Yesenia Delgado — graduates of the June BankWork$ class.

The June BankWork$ class has now graduated! The Wisconsin Bankers Association is proud to partner with Employ Milwaukee to bring this nationwide program to Wisconsin. BankWork$ is a free, eight-week training program to prepare participants in primarily underserved neighborhoods for retail banking careers.

This graduating class of five included Yesenia Delgado, Nayeli Rocha, Dawanda Street, Evan Taylor, and Darnesha Wilson. WBA’s Daryll Lund attended the ceremony and congratulated the graduates on their achievement.

Over the eight weeks, these students learned the hard and soft skills necessary for entry-level retail and operations positions. The program began in 2019 and has so far provided more than 4,000 graduates in the Milwaukee area the opportunity to begin a career in banking.

Thank you to the following banks for sponsoring this program:

- Associated Bank, Green Bay

- Bank Five Nine, Oconomowoc

- First Federal Bank of Wisconsin, Waukesha

- First Midwest Bank, Milwaukee

- Johnson Financial Group

- PyraMax Bank, Greenfield

- Spring Bank, Brookfield

- The Equitable Bank, Wauwatosa

- Waterstone Bank, Milwaukee

- Wells Fargo

By Rose Oswald Poels

By Rose Oswald Poels

Earlier this month, the Wisconsin Bankers Association (WBA) began its 2022–2023 fiscal year. The ceremony, held on June 8, formally installed President and CEO of The Stephenson National Bank and Trust Dan Peterson as WBA’s chair of the Board, welcomed several new Board officers, and thanked several members for their valuable contributions to the association as they ended their terms.

Dan was able to sit down with me for a short conversation to introduce himself to the membership and highlight the goals he has for the organization for the upcoming year.

Dan first started his career in banking as an assistant loan officer at The Stephenson National Bank and Trust in 1988. After gaining experience in all lending areas of the bank, he was promoted to his current role as president and CEO in 2013.

As chair of the WBA Board of Directors, Dan aims to deepen member engagement this fiscal year. Following nearly three years of remote or hybrid events, conferences, and schools, it is no question that bankers throughout the state are looking to reengage with their peers and gain valuable experience outside of the office.

As more education and advocacy-related opportunities at WBA return in person — such as peer groups reconvening at our office in Madison or conferences occurring at venues across the state once again — the membership is encouraged to take advantage of WBA’s selection of options to further develop skills, network among peers, or volunteer time for the benefit of our entire industry.

In addition to taking part in events held by WBA, Dan offers a few other ways bankers may consider deepening their engagement with the association. WBA’s newly renovated office in Madison features a state-of-the-art Engagement Center for members from around the state to use, and the Wisconsin Bankers Foundation (WBF) — WBA’s non-profit arm — offers resources that assist bankers in further engaging and connecting with their communities on the topic of financial literacy.

As Dan, the WBA staff, and I look ahead to another summer and fall filled with opportunities for bankers to deepen their knowledge and expand professional networks — we encourage you and your staff to engage however possible. By joining our CEOnly/CFOnly Network, becoming an Advocacy Officer, or attending any WBA school or event, you assist us in better serving you!

To learn more about WBA Board Chair Dan Peterson and his goals for the upcoming fiscal year, please keep an eye out for WBA’s upcoming July Wisconsin Banker.

WBA Releases Results of Bank CEO Economic Conditions Survey

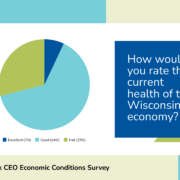

In the Wisconsin Bankers Association’s biannual Economic Conditions Survey of Wisconsin bank CEOs, 71% of respondents rated Wisconsin’s current economic health as “excellent” or “good.” This marks a decline from the mid-year 2021 survey, when 91% of survey respondents gave “excellent” or “good” ratings. Nearly all (over 98%) of the Wisconsin bank CEOs who completed the most recent survey predict that the economy will stay the same or weaken in the next six months.

“Wisconsin bank CEOs have a unique vantage point in that they are both financial experts and highly involved individuals in their local communities,” said WBA President and CEO Rose Oswald Poels. “While the economy remains relatively stable, bankers are keeping a close eye on important indicators and stand ready to support their customers through possible economic challenges over the coming months.“

Among the economic bright spots cited by bank CEOs in the survey were strong tourism, construction, manufacturing, and agricultural industries. Survey results indicate that the hiring market and real estate market are cooling down. Top economic concerns reported by bank CEOs were inflation, cost of living/childcare/education, rising interest rates, oil and gas prices, staffing shortages, and the war in Ukraine.

The mid–year 2022 survey was conducted May 24–June 10 with 56 respondents. Sums may not equal 100 percent due to rounding. Below is a breakdown of the survey questions and responses.

Wisconsin Bank CEO Economic Conditions Survey Results

| How would you rate the current health of the Wisconsin economy. . . | Mid-Year 2022 | End-of-Year 2021 | Mid-Year 2021 |

| Excellent | 7% | 6% | 15% |

| Good | 64% | 73% | 76% |

| Fair | 29% | 20% | 10% |

| Poor | 0% | 1% | 0% |

| In the next six months, do you expect the Wisconsin economy to. . . | |||

| Grow | 2% | 21% | 48% |

| Weaken | 63% | 15% | 39% |

| Stay the same | 36% | 64% | 13% |

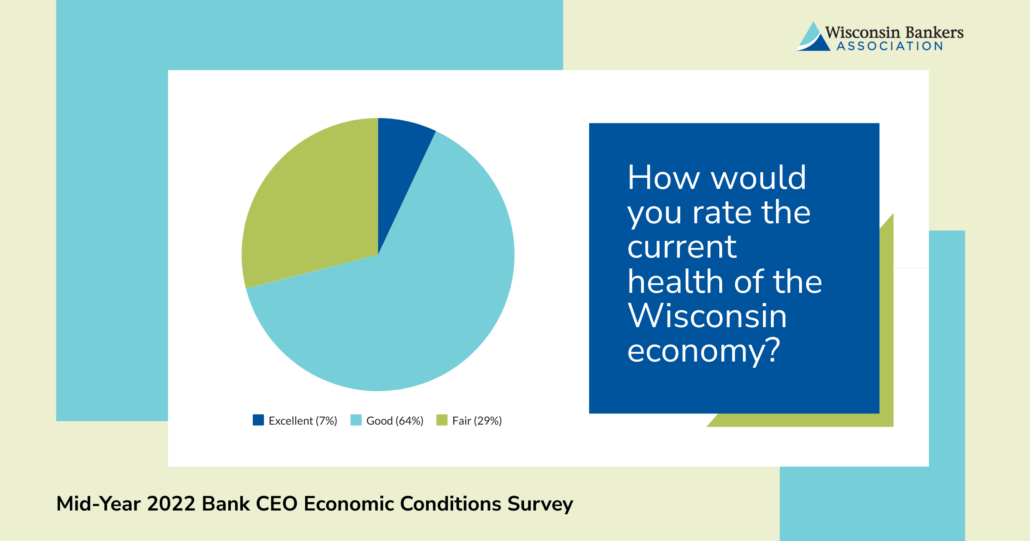

| Over the next six months, do you expect inflation to. . . | |||

| Rise | 50% | – | – |

| Fall | 22% | – | – |

| Stay about the same | 28% | – | – |

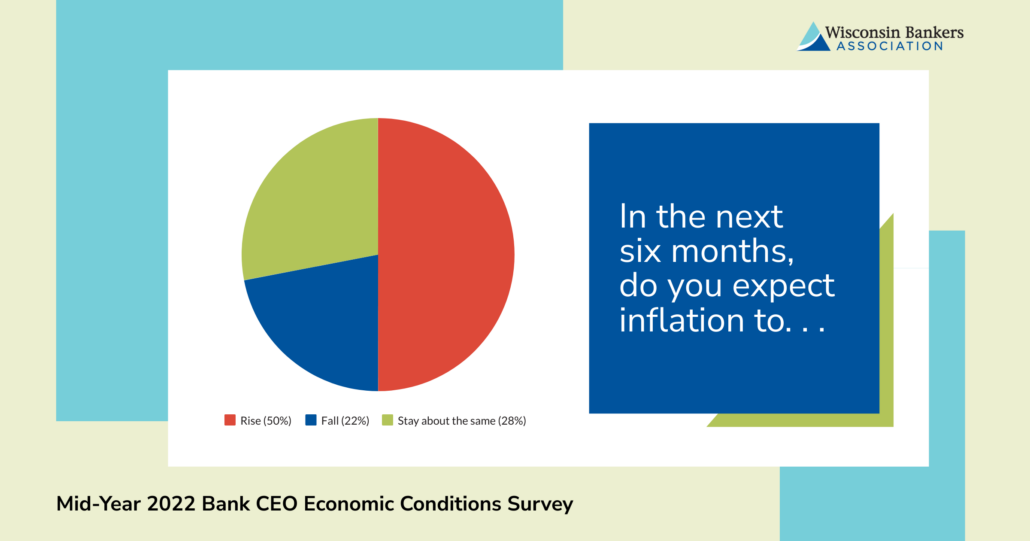

| How likely would you say a recession is in the next six months? | |||

| Very unlikely | 4% | – | – |

| Unlikely | 16% | – | – |

| Neutral | 20% | – | – |

| Likely | 45% | – | – |

| Very likely | 16% | – | – |

| Rate the current demand in the following categories: | |||

| Business Loans | |||

| Excellent | 2% | 9% | 10% |

| Good | 48% | 48% | 30% |

| Fair | 48% | 39% | 52% |

| Poor | 2% | 5% | 8% |

| Commercial Real Estate Loans | |||

| Excellent | 7% | 11% | 13% |

| Good | 52% | 44% | 44% |

| Fair | 36% | 41% | 33% |

| Poor | 5% | 4% | 10% |

| Residential Real Estate Loans | |||

| Excellent | 2% | 25% | 40% |

| Good | 20% | 48% | 48% |

| Fair | 50% | 24% | 12% |

| Poor | 29% | 3% | 0% |

| Agricultural Loans | |||

| Excellent | 2% | 1% | 2% |

| Good | 37% | 22% | 34% |

| Fair | 51% | 58% | 56% |

| Poor | 10% | 18% | 8% |

| Deposit | |||

| Excellent | 5% | – | – |

| Good | 55% | – | – |

| Fair | 38% | – | – |

| Poor | 2% | – | – |

| In the next six months, do you anticipate the demand for the following categories will. . . | |||

| Business Loans | |||

| Grow | 11% | 28% | 43% |

| Weaken | 48% | 14% | 7% |

| Stay the same | 41% | 59% | 51% |

| Commercial Real Estate Loans | |||

| Grow | 13% | 24% | 31% |

| Weaken | 48% | 21% | 8% |

| Stay the same | 39% | 55% | 31% |

| Residential Real Estate Loans | |||

| Grow | 4% | 11% | 14% |

| Weaken | 63% | 56% | 41% |

| Stay the same | 34% | 33% | 46% |

| Agricultural Loans | |||

| Grow | 6% | 15% | 18% |

| Weaken | 31% | 14% | 6% |

| Stay the same | 63% | 71% | 76% |

| Deposit | |||

| Grow | 11% | – | – |

| Weaken | 36% | – | – |

| Stay the same | 53% | – | – |

| In the next six months, are the businesses in your bank’s market area likely to. . . | |||

| Hire employees | 31% | 68% | 82% |

| Maintain current staffing levels | 61% | 33% | 15% |

| Lay off employees | 7% | 0% | 3% |

| In the next six months, is your bank likely to. . . | |||

| Hire employees | 34% | 55% | 48% |

| Maintain current staffing levels | 63% | 43% | 45% |

| Lay off employees | 4% | 3% | 6% |

The Society of Bank Executives offers opportunities for professional development

As the deadline to sign up for the Society of Bank Executives pre-launch session quickly approaches on July 30, c-suite bankers and executive team members are reminded to use this opportunity to invest in their own professional development for the benefit of their entire team.

The Society of Bank Executive, officially launching in January 2023, is offering Wisconsin bankers the ability to participate in the Society’s pre-launch session starting this August. Bankers receive a 25% discount for two years when they sign up before July 30, 2022.

The pre-launch session will focus on honing the skills of trust and team building of bank executives from around the country. During the four-month session, bankers will have the opportunity to hear from Doug Faber, consultant at Franklin Covey during a virtual presentation on “the speed of trust” as well as Casey Thompson, principal consultant at The Table Group during a virtual presentation on “trust and the dysfunctions of a team”. All virtual presentations will also be available on demand for 30 days after the live event.

In addition to learning from experts — Wisconsin bankers are also invited to join bank executives from around the country in Sun Valley, Idaho for a two-day networking event. Not only does this event offer bankers the ability to expand their networks outside of their typical markets, bankers will also be able to share tips from their experience and ask questions of their peers.

The pre-launch session will wrap up in November with a virtual refection moderated by Dr. Paul Godfrey, Society of Bank Executive’s academic advisor. In this final meeting, bankers will reflect on the previous meetings and how they will be able to implement their personal strategy to leverage the power of trust.

Learn more about the Society of Bank Executive by visiting www.executives.bank/home.

Sponsored content by UnitedHealthcare, a WBA Associate Member

Now’s the time to start thinking about your employee benefits package and how an Associated Health Plan (AHP), serviced by UnitedHealthcare, could help you save. Gain similar purchasing power advantages and options that larger employers receive when you join other Wisconsin banks by enrolling in our AHP.

Through your enrollment in an AHP, your bargaining position is strengthened to help you obtain more favorable rates. A variety of flexible plan options are available to help balance costs and your administrative costs can be reduced through economies of scale.

And your employees will benefit too. They’ll have access to UnitedHealthcare’s provider network – the largest in Wisconsin – resulting in less disruption and a smoother transition. Wellness programs designed to motivate healthier habits and cost estimator tools to assist with making more informed care choices will help your employees with their overall health and budgetary goals.

The advantages don’t stop there. If you’re looking to add vision to your employee benefits package, UnitedHealthcare has you covered. Like their medical network, UnitedHealthcare has one of the nation’s largest vision networks. That means your employees will have the freedom to visit their favorite provider or retailer for vision services and eyewear needs. Alliances with Warby Parker® and GlassesUSA.com are included.

Learn more by visiting uhc.com/wba.

June 1, 2021–May 31, 2022

This year, attorneys Heather MacKinnon, Scott Birrenkott, and President/CEO Rose Oswald Poels submitted 16 comment letters in response to requests for comment on rulemaking affecting the banking industry.

Through this process, the WBA Legal Team was able to advocate on behalf of all WBA members for the betterment of the banking industry. From digital assets to examinations and fees, comment letters are a great opportunity for members of the banking industry to inform agencies about the impact of rulemaking and provide examples.

As part of the rulemaking process within the Administrative Procedure Act (APA), all agencies are required to allow the public an opportunity to comment on proposed rules for a prescribed period (minimally 30 days). All WBA members are encouraged to share their comments with federal and state agencies as requested. Information regarding comment letters, or WBA-created letter templates — when available — are typically shared with the membership in the Wisconsin Banker Daily. Additional rulemaking developments at the federal level are compiled in the monthly WBA Compliance Journal.

Once the public has commented, each agency must determine how to proceed given the feedback received. This year, the WBA Legal Team addressed five federal agencies and further helped inform said agencies on the impact of their proposed rulemaking.

Six Comment Letters Filed with the FDIC

Over the past year, WBA filed six comment letters with Federal Deposit Insurance Corporation (FDIC). Two of WBA’s letters commented on FDIC’s actions regarding examinations. In the first, WBA commented on the FDIC’s proposed hybrid approach to bank examinations and in the second, WBA commented on the post-examination surveys related to FDIC Safety and Soundness and Consumer Compliance examinations. In each letter, WBA emphasized the importance of the FDIC establishing consistent coordination and communication with banks.

Three Comment Letters Filed with the CFPB

WBA wrote three letters this year to the Consumer Financial Protection Bureau (CFPB). Most recently, WBA responded to CFPB’s concerns regarding products which feature “junk fees,” assuring CFPB that the Wisconsin financial services marketplace is competitive, featuring a diverse range of high-quality, convenient, innovative, and competitively priced products and services. Additionally, WBA highlighted that, despite CFPB’s concerns, the market is highly regulated, and that further rulemaking is unnecessary as fees are already subject to disclosure requirements.

Four Comment Letters Filed with the FRB

This year, WBA also filed four comment letters with Board of Governors of the Federal Reserve System (FRB). In one of the letters, WBA addressed FRB’s request for comment regarding the evaluation of account and services requests. WBA acknowledged FRB’s attempt to create consistency, but ultimately expressed concern with allowing access to the payment system by entities with little or no regulatory oversight, lack of protection, and minimal capital and liquidity requirements, among others. WBA proposed that FRB establish standards or requirements for users, maintain ongoing review of those involved, as well as coordinate an FRB-led evaluation committee.

One Comment Letter Filed with the HUD

In late May, WBA expressed support of the Department of Housing and Urban Development’s (HUD) proposal to extend a term for loan modifications. The modification would allow mortgagees to modify Federal Housing Administration (FHA) insured mortgage loans by recasting the total unpaid amount due for a new term limit of 480 months — an increase from a term limit of 360 months; allow FHA-loan borrowers similar flexibility and benefits as is available for Fannie-/Freddie-loan borrowers; and creates yet another tool for Wisconsin’s financial institutions to use in their continued work to help find solutions for struggling borrowers to retain their homes.

One Comment Letter Filed with the OCC

In a letter filed with the Office of the Comptroller of the Currency (OCC), WBA was able to comment on a final rule to adopt a new Community Reinvestment Act (CRA) framework. This regulation facilitated the issuance of joint CRA to an interagency basis which would allow for greater coordination on all CRA ruling between the OCC, FRB, and FDIC for the benefit of banks serving low- and moderate-income communities.

One Interagency Comment Letter Filed

Some rulemakings are issued on an interagency basis. This year, WBA commented on the FRB, FDIC, and OCC’s proposed interagency guidance on third-party relationships related to risk management. In the letter, WBA commented that this effort would promote consistency in their guidance as well as clearly articulate risk-based principles. In addition, WBA identified several ways Wisconsin banks will be impacted by the new guidance during final implementation.

Conclusion

Industry comment is a critical aspect to the rulemaking process. It is an opportunity for the industry’s voice to be heard, and it is important that the agencies hear from banks about how rulemaking affects you. WBA welcomes feedback on comment letters because it is key that we, and the agencies, hear directly from members.

For more information on the rulemaking process, comments, and upcoming rules, contact the WBA Legal Department at wbalegal@wisbank.com. For a full list of the comment letters filed during the 2021–22 fiscal year, visit www.wisbank.com/advocacy/comment-letter-library.

*This article has been updated from previous published editions

From the Desk of Rose Oswald Poels

From the Desk of Rose Oswald Poels

Every day, bankers throughout the state make remarkable efforts to assist their neighbors in building a solid financial future. This tradition often goes above and beyond the normal role of bankers — taking them into classrooms or community centers — and has proved time and time again the value of the connections formed by community bankers in assisting Wisconsinites of all ages to gain important financial education. Our industry does not get enough recognition for all it does since bankers are often quick to deflect attention and praise to others.

This article serves as a reminder of the various recognition and awards that you — individually and as a bank — may apply for. I encourage all of you to take the time to apply and be recognized for the dedicated and often creative work you do to improve financial education.

Individual Financial Education Efforts

The Wisconsin Bankers Foundation (WBF) recognizes individual bankers for their financial literacy efforts throughout its fiscal year. Bankers are able to submit summary forms recognizing each presentation, visit, or volunteer time spent with classrooms and community members focused on increasing financial literacy. WBF compiles total numbers of presentations and/or outreach events and awards bankers based on these totals. I highly encourage bankers to submit their forms reflecting their individual efforts in financial education from June 1, 2021 to May 31, 2022 by the July 31 deadline. To begin submitting your summary forms, visit www.smr.to/p80094. These awards are presented in the fall at WBA’s Lead360 Conference.

Bank-Wide Financial Education Efforts

WBF also recognizes banks as institutions for the aggregate time spent by employees during the period from June 1, 2021 through May 31, 2022 on financial education efforts. Since this award is based on the aggregate time spent by each bank on financial education initiatives, several banks may win this award. In addition, a bank may also submit an application for WBF’s most prestigious award, the Financial Education Innovation Award. This award recognizes only one member bank for its innovative approach to financial education. To learn more about WBF’s bank-wide awards or submit the summary form by July 31, visit www.smr.to/p77960.

WBF’s Bank Award

The Bank Award compiles the various financial education efforts put forth by the whole bank and showcases the tremendous work done by all employees. This award is presented in the fall at WBA’s Lead360 Conference.

WBF’s Financial Education Innovation Award

The Financial Education Innovation Award recognizes one bank for adopting an innovative, creative, and/or unique approach to financial education annually. Now presented at WBA’s Bank Executives Conference in February, this well-deserved honor recognizes a bank’s innovative approach to financial education.

2022 Governor’s Financial Literacy Awards

In addition to submitting a summary of financial education activities and efforts to WBF for recognition, I highly encourage bankers around the state to also consider applying for one of three categories of the 2022 Governor’s Financial Literacy Awards.

Recipients are selected by a subcommittee of the Governor’s Council on Financial Literacy and Capability based on their excellence in increasing financial literacy, capability, and inclusion among Wisconsin residents. I am proud to be a member of this Governor’s Council but have noted that in the past few years very few banks have been applying for this recognition all the while credit unions are applying. The awards highlight individuals, businesses/organizations, and legacy efforts throughout the state to improve financial education.

I highly encourage banks to share their financial education efforts by submitting the 2022 Governor’s Financial Literacy nomination form by the December 2 deadline for the chance to be recognized for the outstanding work bankers engage in every day. The nomination forms are now available, so do not wait until later this year to submit your bank’s nomination.