CUs Continue Expansion Into Wisconsin Markets

By Hannah Flanders

Earlier this year, one of the largest credit union acquisitions of a bank nationwide occurred in Wisconsin. As the deal between Commerce State Bank, West Bend and Summit Credit Union, Madison prepares to close in the third quarter of 2022, it is becoming increasingly important that WBA and its membership act in opposition of further credit union expansion and hold these institutions accountable for the implications to Wisconsin’s economy.

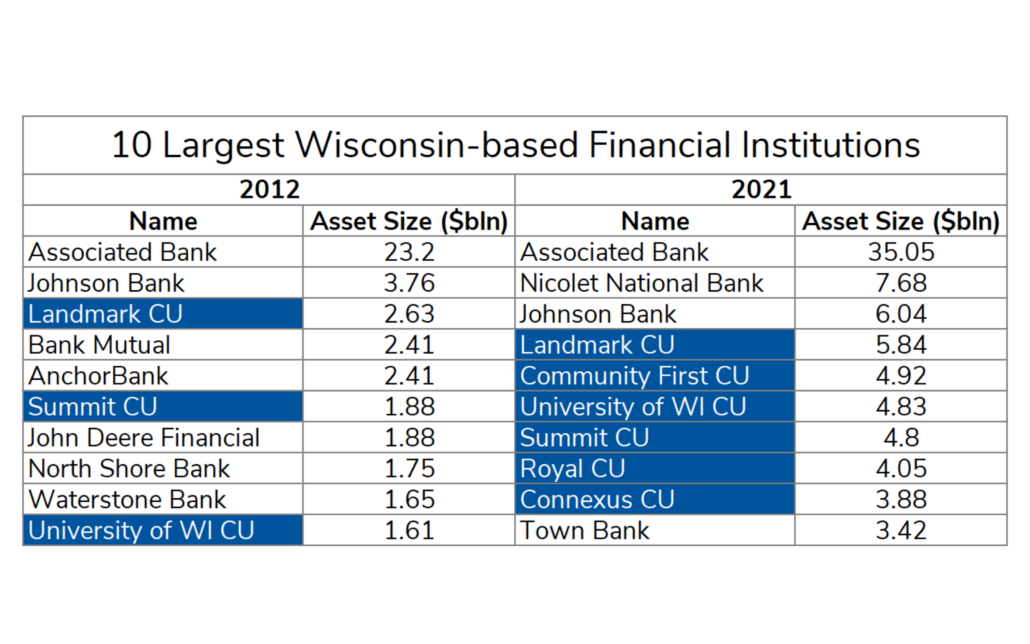

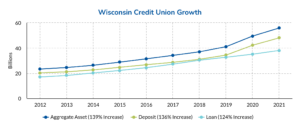

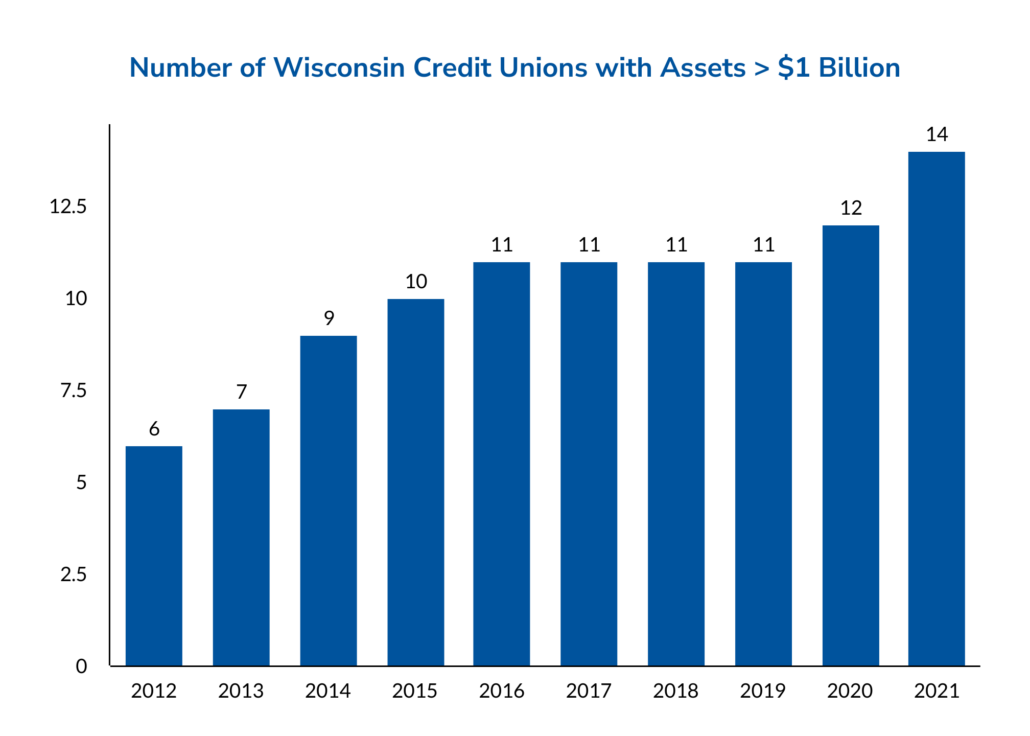

First established in the early 1900s, credit unions aimed at providing access to credit and financial services to those of low or modest means. However, since their inception in the U.S., credit unions have largely gone unrestrained and have expanded into entities nearly indistinguishable from banks. As of May 2022, six of the 10 largest financial institutions in the state of Wisconsin were credit unions. Of these credit unions, 14 have equal to or greater than one billion dollars in assets, operating essentially as large commercial banks — aside from their tax-paying status.

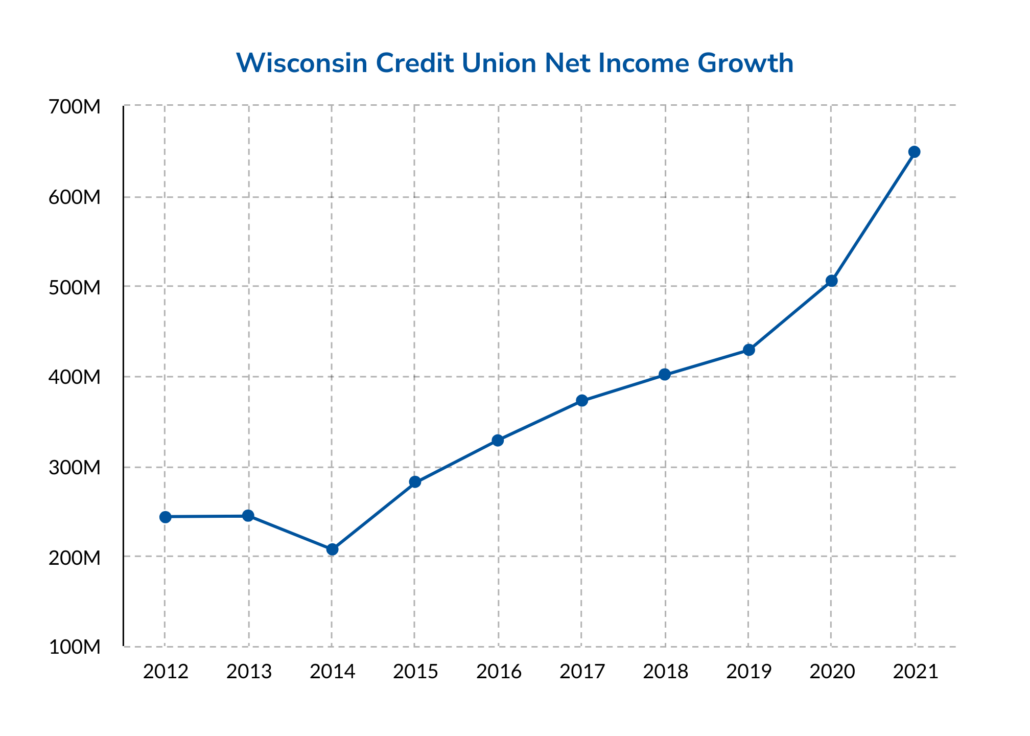

Due to their not-for- profit status, credit unions are exempt from federal and state income taxes. As these institutions remain widely unchallenged by regulators, credit unions take advantage of their tax-exempt status for their own asset growth and continue to expand far beyond their employer- or neighborhood-focused origins.

Why Community Banks?

Unfortunately, acquisitions of Wisconsin banks by large, growth-oriented credit unions — such as the case with Commerce State Bank and Summit Credit Union — have become increasingly common over the last several years. In total, six whole-bank acquisitions by credit unions have taken place in Wisconsin since 2014.

Throughout the country, 13 whole-bank acquisitions by credit unions took place in 2021 alone — an alarming trend that is expected to continue through 2022 and beyond.

As member-owned organizations, credit unions have a unique interest in community banks. Due to small banks having close ties to their communities and often offering specialized services — such as digital banking or business lending — credit unions have the ability to expand their portfolios and their assets through the acquisition of a bank all while gaining new members.

Increasing competition for both employees and customers has significant impacts on financial institutions across the country. Growth-oriented credit unions in Wisconsin are increasingly lenient in the addition of new members, often not verifying that these customers align with those they are intended to serve.

“These multi-billion-dollar credit unions around the state are able to gain momentum though tax-subsidized acquisitions,” states WBA Vice President — Government Relations Lorenzo Cruz. “Community banks are often unable to compete with rising investor interest in merger and acquisition activity and premium offers.”

In addition to their tax-exempt status, credit unions — despite having been founded to provide greater access to financial services — have no requirement to participate in providing Community Reinvestment Act (CRA) investments, or similar programs, to low- and moderate-income (LMI) neighborhoods. These excess funds that are not allotted into community efforts or back into their membership can be used as leverage for purchasing banks.

As many Midwestern banks continue to be the target of credit union expansion, it is likely — according to a report published by Wilary Winn LLC — that a buying credit union will bid entirely in cash. This type of offer, already difficult for shareholders to refuse, has reportedly been upwards of three times higher than other bids in some cases.

An Unfair Advantage

In statement released by WBA President and CEO Rose Oswald Poels shortly after the Commerce State Bank acquisition was announced in March, Oswald Poels highlighted the need for fair and healthy competition within the financial service industry. As credit unions continue to expand their geographic footprint and offerings to members, these institutions have quickly become increasingly indistinguishable from tax-paying banks.

Membership to a credit union often costs as little as $5 — but with thousands of members across the country and no requirement to pay income taxes in many states — these profits continue to rise. Credit unions are often able to offer extremely low rates on services. If credit unions abided by their intended mission to only serve specific communities, these low rates would only affect a small percentage of population — however — in 2021, the Credit Union National Association (CUNA) reported that membership had risen to above 130 million Americans.

Community banks do not have the same flexibility with their rates and therefore, are often unable to compete with the rates of credit unions. As highly regulated organizations, the cost of some banking services may be intentionally or unintentionally affected by agencies, including the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System (FRB), or the Federal Deposit Insurance Corporation (FDIC).

Of course, the greatest damage to Wisconsin’s economy comes from the loss of tax revenue each time a bank is acquired by a credit union. Annually, the U.S. Treasury loses $2.6 billion in income tax revenue across the country as many of the largest financial institutions remain tax exempt, according to information provided by the American Bankers Association (ABA). As more and more banks are acquired by tax-exempt credit unions, this number will continue rise — forcing the burden onto individuals and tax-paying businesses and ultimately limiting consumer choice.

Taking Action

With the number of banks headquartered in the state decreasing each year — and the number of credit unions throughout the country continuing to rise — WBA has placed even greater emphasis than ever on advocating in opposition of all credit union expansion.

Over the last 10 years, credit unions around the country have acquired $11 billion in bank assets, according to the ABA. While Wisconsin law continues to allow banks to sell all or a substantial portion of their assets to other companies, given that several criteria are met, many states have made considerable moves in legislation against whole-bank acquisitions in their state by credit unions. So far, Colorado and Iowa have barred state-chartered banks from selling to credit unions.

Last year, WBA advocated in opposition to AB 478/SB 451 which ultimately would have allowed credit unions even further opportunities to expand throughout the state.

In addition to this state legislative effort, WBA regularly joins other state banking associations at the federal level in efforts to keep credit unions in check. These combined efforts not only unite the banking industry throughout the country but also emphasize to legislators the important role bankers play in every community.

“Wisconsin is experiencing a disturbing trend of credit unions buying banks. These acquisitions result in a direct loss of tax revenue to the state and federal government which places more of the burden on individuals and taxpaying businesses to support meaningful government and social services such as law enforcement, health insurance for low-income families and their children, infrastructure, and education,” says Oswald Poels. “WBA repeatedly questions the public policy rationale for allowing these acquisitions to occur with state and federal lawmakers highlighting the detriment to our state every time one is announced.”

“Wisconsin is experiencing a disturbing trend of credit unions buying banks. These acquisitions result in a direct loss of tax revenue to the state and federal government which places more of the burden on individuals and taxpaying businesses to support meaningful government and social services such as law enforcement, health insurance for low-income families and their children, infrastructure, and education,” says Oswald Poels. “WBA repeatedly questions the public policy rationale for allowing these acquisitions to occur with state and federal lawmakers highlighting the detriment to our state every time one is announced.”

Though the future of credit union expansion — both in Wisconsin and around the country — is uncertain, it is clear that so long as they remain untaxed, unchecked, and underregulated, credit unions will continue to extend their reach far beyond their intended purpose. As growth-oriented credit unions continue to be a detriment to the overall health of the state’s economy, WBA encourages bankers to advocate on behalf of the industry. Whether it be volunteering as a WBA Advocacy Officer to speak with elected officials or in day-to-day conversations with community members — bankers play an important role in holding credit unions accountable.