By Jason Young

As the new year approaches, many institutions will reflect on their goals and plans for the year ahead. And some may even begin evaluating whether to change core providers as current contracts near expiration. But what should bankers consider when deciding upon the best core bank system?

We used findings from surveys, industry research reports and interviews from recent years to develop eight factors that banks should keep in mind when deciding on the right core banking platform.

Top Considerations for Evaluating a Core Platform

Factors for switching technologies include cost, satisfaction with their existing technology suites, or a cultural mismatch with their provider. But since a conversion often overhauls business processes and takes a considerate monetary and time investment, deciding on the right partner requires a great deal of consideration and discussion with key stakeholders at the bank. Here are eight factors that should play a part in bankers’ evaluation of core platforms:

1. Expected Comprehensive Functionality

Bankers favor a core platform approach to technology primarily because it eliminates dealing with multiple vendors and disjointed experiences. So, it’s hardly surprising that product suites and functionality top the list of essentials as bankers begin searching for a new core.

Core contracts can last for decades, so banks must consider whether the vendor’s technology will successfully carry them into the future and grow alongside them. A core banking platform must offer comprehensive functionalities to support various banking operations, including customer onboarding, account management, deposits, loans, payments and reporting. This also includes integrating digital banking solutions to rival big banks and digital experiences elsewhere.

2. Whether a Core Will Maximize Return on Investment

Banks evaluate the cost-effectiveness of a core banking platform by considering factors such as the initial implementation investment, ongoing support costs and potential customization or integration expenses. The best deals with new technologies often originate from the core vendor or their existing partners, as there are fewer implementation and integration steps.

Although customer demands often drive technological priorities, most investments ultimately seek to save money one way or another. For instance, responsive cloud-based architecture can eliminate some software and hardware expenditures. Built-in efficiencies like streamlined onboarding can also bolster the bottom line by helping customers open accounts and spend money from them faster.

3. Core Banking Platform Customization and Ease of Use

Bankers look for banking functions to reliably fit together and interact cohesively. The core platform should be easily navigable with search functionality, easy-to-decipher data, readily available tutorials, and reliable service representatives who assist with the platform as needed.

On the vendor side, a thoughtful adherence to UX design principles can go a long way. Bankers often praise platforms with an aesthetic appeal, a natural hierarchy, straightforward language and accessibility. Overall, they look for consistency throughout the platform to create a coherent, straightforward experience when serving customers or accessing their data.

4. The Reliability and Stability of the Core Platform

Given the stakes of employee demands and increasing competition, banks require a core banking platform that is reliable and stable. It should be capable of handling high transaction volumes and processing requests accurately and efficiently while maintaining uninterrupted service availability.

If there are service interruptions, those support tickets should be resolved as promptly and effectively as possible. For that reason, many banks ask questions in the determination phase about how many support tickets a technology logs in a given week and how long it takes to resolve them. Further, a solid platform should have stringent security measures, including data encryption, access controls, audit trails, and compliance with regulatory standards.

5. The Quality and Accessibility of Bank Data and Analytics

Easy access to core data represents a massive advantage for a growing bank. Bank data and analytics offer insight into customer behaviors, performance indicators and regulatory reporting requirements. Accessing and querying core data should easily enable banks to identify opportunities for growth and relationship extension. As such, these banks look for robust reporting tools, account analysis and data-driven insight into customer profitability.

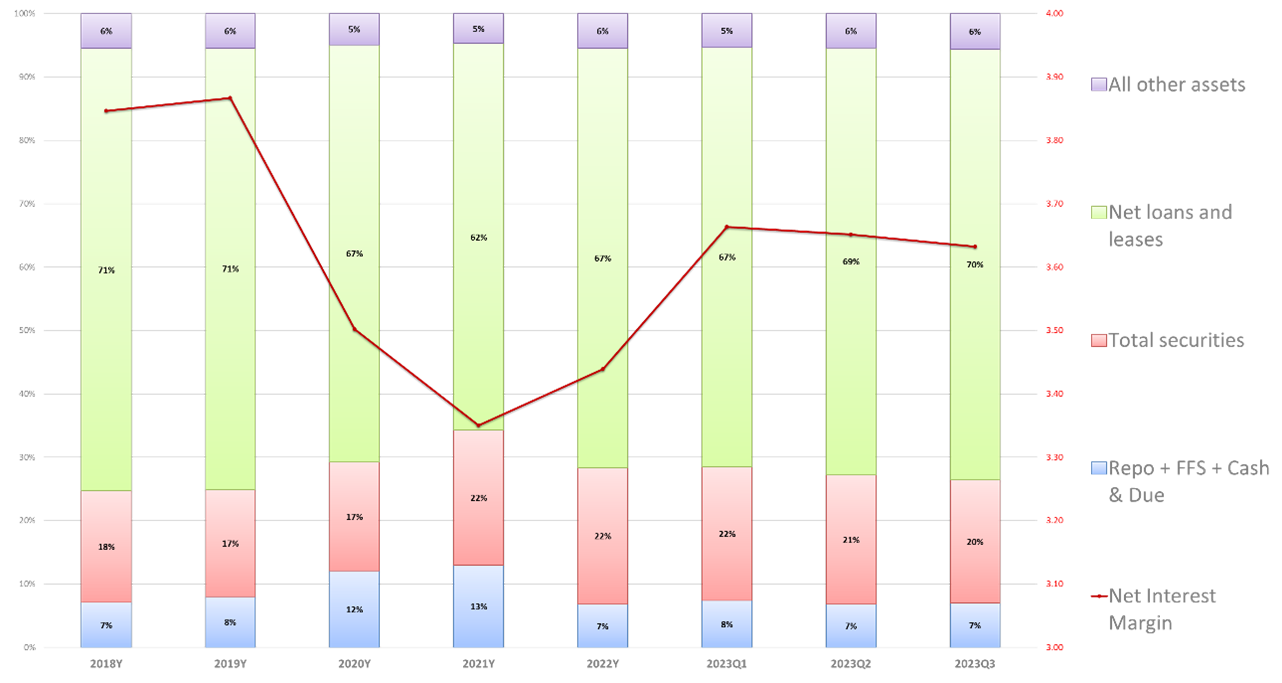

Customer relationship management (CRM) is one such data source that offers efficiencies, as it enables bankers to track behaviors and transactions across the system on the customer level. Many banks also look for insight into overall profitability and net interest margin, as well as narrow performance analysis of branches and officers.

6. The Core’s Scalability and Flexibility

Most institutions seek out a core platform that supports growth and can scale accordingly. This includes accommodating increased transaction volumes, additional branches, and new products or services.

While there are similarities across the board, every bank also has unique business processes and customer needs. Extensive API catalogs and support for third-party technology integrations assist in that pursuit and enable institutions to stay adaptable, even if the core provider doesn’t have the exact solution the institution needs. The resulting agility ensures that banks can quickly respond to market demands, regulatory requirements, and technological advancements.

7. Tight Integration of All Banking Systems

A cohesive core banking platform allows for easy data transfer that reduces expenses, opens accounts faster and enables the ability to launch new products more affordably. It also improves the overall user experience by making each component piece — even if it was added later or by a different vendor — fit into the technological puzzle without feeling tacked on or behaving like a disparate, siloed system.

The standard of integration relates closely to the user experience, as it can help eliminate redundant processes and offer a more seamless feel. Tight integration also encompasses the digital experience — meaning the bank’s digital experience on a phone should mirror that on a laptop or tablet.

8. Core Vendor Support and Expertise

Finally, the reputation and service offered by the core banking platform vendor are vital considerations for banks. While system functionality is vital in vetting the provider, the decision often comes down to which vendor will make the best partner, both in innovation strategy and culture.

To understand whether the technology provider is a good fit, bankers often assess their industry reputations, the quality of interactions and how they answer questions. It’s also worthwhile for many to follow up with as many references as possible and ask other bankers’ opinions at networking events.

Bankers also emphasize the importance of reliable technological implementations. They expect products to be fully ready for use, avoiding delays and ensuring a successful rollout that meets the needs of their customer base. Banks also require reliable assistance and dedicated personnel who can address their concerns reliably and proactively.

Searching for the Right Core Banking Platform

By carefully evaluating core banking technology, banks can empower themselves to thrive in the digital age while delivering exceptional customer service and creating a lasting partnership with their technology provider.

Young is Head of Core Banking at CSI, a WBA Associate Member.

By Daryll Lund

By Daryll Lund

Aubree S. Rehmke is a Risk and Regulatory Compliance Consultant for Vantage Point Solutions based in South Dakota. Aubree has almost 20 years of experience in the financial services industry, and she has a passion for mentoring employees new to their roles in compliance and BSA. For most of her career, she served as the compliance officer and human resources manager for a small community bank in eastern Iowa. Aubree is a Certified Regulatory Compliance Manager and brings a broad range of regulatory and consumer compliance knowledge to the Vantage Point financial services team. She holds a B.A. from The University of Iowa and a diploma from the Graduate School of Banking at the University of Wisconsin-Madison where she also earned a certificate in executive leadership. Aubree resides in Dubuque, Iowa.

Aubree S. Rehmke is a Risk and Regulatory Compliance Consultant for Vantage Point Solutions based in South Dakota. Aubree has almost 20 years of experience in the financial services industry, and she has a passion for mentoring employees new to their roles in compliance and BSA. For most of her career, she served as the compliance officer and human resources manager for a small community bank in eastern Iowa. Aubree is a Certified Regulatory Compliance Manager and brings a broad range of regulatory and consumer compliance knowledge to the Vantage Point financial services team. She holds a B.A. from The University of Iowa and a diploma from the Graduate School of Banking at the University of Wisconsin-Madison where she also earned a certificate in executive leadership. Aubree resides in Dubuque, Iowa.