Crossbridge Community Bank is proud to announce the promotion of PJ Childers as the new president of Crossbridge Community Bank, Crossbridge Mutual Holding Company, and Crossbridge Financial Inc. effective April 15, 2024. Her role will include overseeing operations and strategic planning for the bank alongside Crossbridge CEO, Mark Zulliger. She will also take a seat on the Crossbridge Community Bank Board of Directors.

Childers is a 19-year veteran of Crossbridge Community Bank and most recently held the title of Senior Vice President of Commercial Lending. She has been part of the executive leadership team for the past 7 years and has been integral to the creation and implementation of the banks 2022 rebrand.

“PJ has always had a clear and distinct vision to propel the bank into our next era. She is rooted in the community and is an example of the integrity and service model that drive our organization,” said Crossbridge CEO Mark Zulliger.

Childers said of her new role, “I am very excited for this next step in my banking career. Crossbridge Community Bank is more than just an employer. To be able to work for an organization that puts purpose first has truly been fulfilling.”

Childers graduated from UW La Crosse with a bachelor’s degree in finance. She also completed the Wisconsin Banking Association School of Bank Management and in 2019 became a graduate of the Graduate School of Banking at the University of Wisconsin – Madison.

She is a longtime board member of the Tomahawk STAR Foundation and Tomahawk Hockey Association. She recently completed her term on the Wisconsin Bankers Association BOLT (Building Our Leader of Tomorrow) board. She was fortunate to have traveled to Washington D.C. to meet with banking regulators as part of a WBA advocacy trip. She has previously been on the board of Tomahawk Main Street, Tomahawk Youth Baseball, and Lincoln County Partners in Education.

Childers succeeds Kathy Rankin who recently retired after 46 years with Crossbridge. “I have been beyond blessed to have had Kathy Rankin as a mentor for the past 19 years. Though she has some pretty big shoes to fill, I’m confident I will make her proud. I’m looking forward to working alongside our CEO Mark Zulliger to continue to grow in my banking career and help mentor and lead our staff here at Crossbridge.” Childers added.

“We are pleased to see PJ’s ascension to president. She embodies what it means to be a community banker,” said Crossbridge Community Bank Chairman of the Board, Kyle Zastrow. “Our belief in local talent and organic professional growth via strong mentors/role models is evident with her promotion. We look forward to her imprint on Crossbridge for years to come in her expanded role.”

One Community Bank is proud to announce its recognition as one of the top Small Business Lenders in 2023, as listed in In Business Madison magazine. This recognition highlights OCB’s dedication to supporting local entrepreneurs and economic growth within local communities.

One Community Bank is proud to announce its recognition as one of the top Small Business Lenders in 2023, as listed in In Business Madison magazine. This recognition highlights OCB’s dedication to supporting local entrepreneurs and economic growth within local communities.

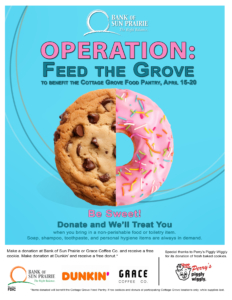

As a growing organization, One Community Bank is thrilled to open the doors at its newest bank location – One Community Bank Cottage Grove. The new location is located at 1565 Landmark Drive between Commerce Parkway and Limestone Pass.

As a growing organization, One Community Bank is thrilled to open the doors at its newest bank location – One Community Bank Cottage Grove. The new location is located at 1565 Landmark Drive between Commerce Parkway and Limestone Pass. Forward is supporting the Medford School District and their efforts to update the Raider Hall floor with a $56,000 donation. The gym is used by athletes and students of all ages attending or participating in numerous sporting events.

Forward is supporting the Medford School District and their efforts to update the Raider Hall floor with a $56,000 donation. The gym is used by athletes and students of all ages attending or participating in numerous sporting events.