Economic Report: Tight Inventory Constrains Wisconsin Home Sales as Unmet Millennial Demand Pushes Prices Higher in 2023

By Tom Larson, with insights from David Clark, Wisconsin REALTORS® Association

For a second straight year, Wisconsin’s existing home sales slowed compared to the previous year, and this was primarily because of very low inventory levels. While there was some modest softening of demand pressure in 2023 as housing affordability slipped, housing demand remained solid especially for first-time millennial buyers. Millennials have now surpassed the Baby Boom generation in size, and while they delayed moving into owner-occupied housing in the immediate aftermath of the Great Recession, they are now forming households and buying single-family homes.

The problem they now face is a shortage of homes available on the market. A rule-of-thumb in housing is that a market is balanced if there is six months of supply. Less than six months signals a seller’s advantage and using that benchmark, Wisconsin has been in a persistent seller’s market since August 2017. In October 2023, there were just 3.3 months of available supply. This tight supply combined with solid demand resulted in a 20% reduction in year-to-date home sales through October 2023, compared to the first ten months of 2022, and it drove home sale prices up 8.3% over that same period.

Unfortunately, the combination of strong price pressure, relatively high mortgage rates, and slowing income growth has pushed statewide affordability down substantially. The Wisconsin REALTORS® Association (WRA) Housing Affordability Index shows that portion of the median priced home that a buyer with median family income qualifies to purchase, assuming a 20% down payment and the remaining balance financed with a 30-year fixed-rate mortgage at current rates. The index showed that qualified buyers could purchase 127% of the median priced home in October 2023. The index was 139% in October 2022, and it was 203% in October 2021.

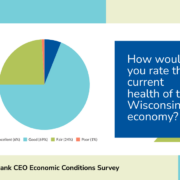

Although many economists expected the national economy to weaken in 2023 because of the Fed’s aggressive increase in short-term interest rates, real (inflation-adjusted) GDP has shown remarkable resilience throughout the year. Real GDP grew at just over 2% in each of the first two quarters of 2023, but it grew at 5.2% in Q3, which is the strongest showing since Q4 of 2021. Moreover, there has been consistent improvement in inflation, with the Fed’s preferred measure of core inflation falling to 3.5% in October 2023. While this remains above the Fed’s target of 2%, it is at its lowest level since April 2021. In addition, measures of consumer confidence published by the Conference Board indicate that consumers are relatively pessimistic about the future economy, with about two-thirds of those surveyed in November 2023 perceiving the risk of a recession in the next 12 months to be “somewhat likely” or “very likely.”

Since consumer spending accounts for about 70% of real GDP, any change in spending patterns can lead to recession. Both the progress on inflation and the weak consumer confidence measures will likely preclude more short-term interest rate hikes by the Fed to further slow the economy.

There are some preliminary signs that supply constraints are moderating. New listings of existing homes in the state improved 2% in October 2023 compared to a year earlier. Furthermore, while months of supply continued to signal a seller’s market, they did improve from October 2022 when there was just 2.7 months of supply.

The Fed remains committed to taming inflation, and hopefully they will be able to achieve a so-called “soft landing.” Congress and the president need to do their part by controlling spending to avoid creating more inflationary pressures. Finally, we want to thank Governor Tony Evers and the Wisconsin Legislature for the historic $525 million investment in new housing supply. This is a great start, and we encourage state and local officials to continue to pursue policies that will help improve the supply of housing. This includes lowering the regulatory burden for new construction and finding creative strategies to create affordable workforce housing.

Larson is president and CEO of the Wisconsin REALTORS® Association | Clark is professor emeritus of Economics at Marquette University | Founded in 1909, the Wisconsin REALTORS® Association (WRA) is one of the largest trade associations in Wisconsin. It represents and provides services to more than 15,000 members statewide. WRA’s goal is to promote the advancement of real estate in Wisconsin and provide cutting-edge tools to help REALTORS® enjoy a successful career and be competitive in their market.