By Lorenzo Cruz

With the fall elections finally behind us, the Wisconsin Bankers Association (WBA) can begin pivoting in preparation for the 2023 legislative session and another round of elections occurring this spring. The passage of a state budget that includes a $6.6B budget surplus will occupy the time of most legislators, the Governor, and state agency heads. A State Supreme Court race and a special election for the 8th State Senate District will keep the candidates busy and usher in another flood of campaign spending.

Last year, outside groups shattered the previous record and spent more than $93M on the Governor and other state races, according to the Wisconsin Democracy Campaign. The skyrocketing campaign costs and the increasing need to support pro-banking candidates requires WBA to double down on the financial equation of its advocacy infrastructure. With the start of the new year, our Association is kicking off two new initiatives — the WBA Leadership Circle and the Hall of Fame — and making changes to contribution levels for the Silver Triangle Club and Gold Triangle Club.

New Opportunities to Engage

WBA’s Leadership Circle is for major investors and passionate bankers who are committed to investing and creating a healthy future for member banks and the communities they serve. To join the Leadership Circle at the platinum level, a major investor would need to contribute $3,000 or more annually to Wisbankpac (PAC) and/or Alliance for Bankers Conduit (ABW).

To achieve Hall of Fame designation, a major investor would need an aggregate lifetime investment of $25,000 or more. Leadership Circle and Hall of Fame investors benefits could include: lapel pins, certificates, pens, online recognition, Wisconsin Banker picture recognition, Capitol Day/Conference recognition, and exclusive invitation to special events.

The personal contribution level has been increased from $500 to $1,000 for the Silver Triangle award. Individual bankers can earn the award by contributing $1,000 to any combination of the PAC, ABW, or WBA’s issue advocacy fund. Silver Triangle recipients are honored annually at WBA’s Bank Executives Conference.

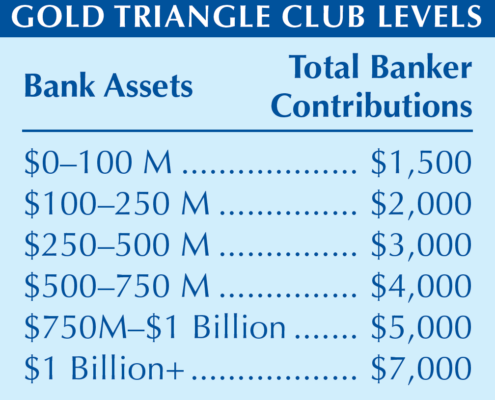

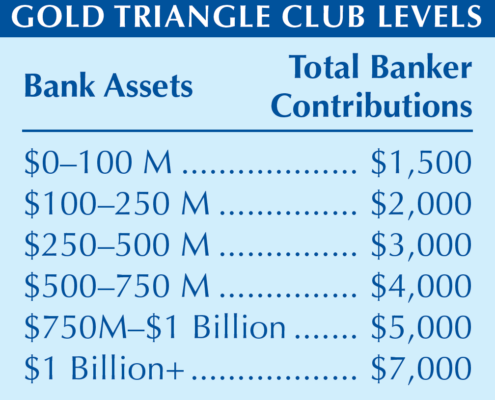

To receive WBA’s Gold Triangle recognition, the total contribution amounts for banks based on assets have been increased to:

Gold Triangle is the highest level of bank fundraising recognition which can be achieved by employees contributing to the PAC or conduit or through corporate contributions to WBA’s issue advocacy fund.

Looking Ahead

As we transition into 2023, it is critical that bankers join forces with the Government Relations team to replenish the depleted coffers for the PAC, conduit, and issue funds. Growing the funds allows us to support pro-banking elected officials and provides a seat at the table for those able to positively shape and influence legislation and rules impacting the industry. WBA urges Advocacy Officers to meet with bank employees to encourage them to help us meet the year-end 2023 goal of raising $300,000 in political donations.

While WBA’s advocacy infrastructure is strong, it is important to build and expand upon it. Last year, our industry faced many legislative threats, from credit unions to credit card swipe fees. These challenges will likely return in 2023 as well as a wide range of other issues like elder fraud, taxation, banking modernization, fair access, trust code, and privacy. Our Association and its members cannot afford to be bystanders while other organized and well-financed groups push legislative solutions that are harmful to banks.

While WBA is taking a proactive lead to ensure that public policies adopted are beneficial to the industry, it is critical to enlist the help of bank leaders to expand the base by designating an Advocacy Officer if they have not already done so. Moreover, WBA’s Government Relations team calls upon all bank executives, Advocacy Officers, and bankers to step up and answer the call to support WBA’s advocacy infrastructure by joining the Leadership Circle, being a Hall of Fame member, becoming a Silver Triangle member, and achieving Gold Triangle and BIGG recognition.

Now more than ever is the time to unify behind strengthening and expanding WBA’s advocacy infrastructure. The political stakes are high, but together we can function as one united voice amplifying WBA’s priorities at the State Capitol while protecting the interests of member banks doing business in Wisconsin.

By Rose Oswald Poels

By Rose Oswald Poels