2022 Forecast Looks Good, But Bankers Must Act

By Kenneth D. Thompson, WBA Board chair, president and CEO of Capitol Bank, Madison

By Kenneth D. Thompson, WBA Board chair, president and CEO of Capitol Bank, Madison

After the challenges of the last several years, I believe I speak for everyone when I say I am continually amazed by the optimism that Wisconsin bankers hold not only for the growth of our industry, but for our economy and communities as well. Although the COVID-19 pandemic continues to wreak havoc, I expect 2022 to be a year of immense growth and transition within our industry.

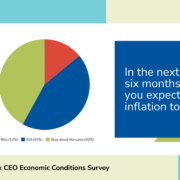

As bankers, we are fortunate to have a unique perspective on our economy and communities. As many member CEOs highlighted in WBA’s recent Economic Conditions survey, despite recent obstacles, a majority of Wisconsin bankers rate the current health of the economy as ‘good’ and predict this to stay the same well into 2022.

Our work in providing flexibility to our staff and customers, as well as exceeding expectations of managing liquidity and technological growth in 2021, has absolutely aided in our efforts to provide stability in times of uncertainty. Our industry will continue to be challenged into 2022 as we face inflation; ongoing COVID protocols surrounding vaccinations, boosters, and possible mandates; as well as talent retention.

However, as mentioned repeatedly by Minneapolis Federal Reserve Bank President and CEO Neel Kashkari during WBA’s annual Midwest Economic Forecast Forum, Wisconsin’s economy and our region as a whole has been on par with the recovery of the nation. Efforts by our community banks have not gone unnoticed and have played, and will continue to play, a substantial role in rebounding our economy.

Of course, innovation will remain the name of the game as banks navigate uncertainty. The next eleven months will certainly show the flexibility, creativity, and expertise of banks in Wisconsin and set our industry apart.