From the Fields: Choppy Waters Ahead for Row Crops in 2024

By Adam Sommer

Winter in Wisconsin is defined by many words, but rarely are the words crisp or comfortable one of them. February has brought some unseasonably warm weather to the state as we wrap up the month, and it has been quite crisp and comfortable. It has left us dreaming of spring. With spring comes one of the wonderful seasons of year on the farm. Crops are being sewn across the state, calves are being born, and the season brews new hope for the agricultural year to come.

However, 2024 looks like a year of some uncertainty across many agricultural fronts in Wisconsin. Interest rates have remained higher than recent memory, inputs are costly, and commodity prices have tumbled. Farmers are whispering of concerns for what the year ahead looks like, and choppy waters look like a near certainty.

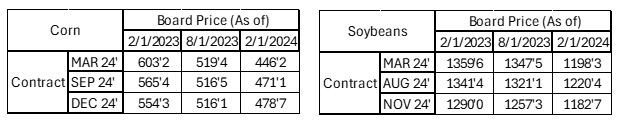

So, what does this mean for our row crop operators? A year of tighter margins and pricing challenges is likely ahead. Barring global economic shifts, geopolitical forces upending the current pricing outlook, or a major weather event changing the current trajectory, farmers are preparing for prices that are down from a year ago. Below are two charts (one for corn and one for soybeans) using CME Group data on pricing for the March, September, and December corn contracts, and using the same data on pricing for the March, August, and November soybean contracts. This illustrates the trend we continue to see for both old crop and new crop pricing in 2024.

Even as the trend points down for crop pricing, many farmers here in the state of Wisconsin will reference a dry 2023 crop year and the hope for a spring bump in price. Anecdotally, there is still a large amount of grain stored in bins across Wisconsin. This unpriced crop could be troubling for the income statements of farmers, in some cases, against borrowed funds. The concern is that even as the year was dry, production remained at a strong, although not bin-busting, level. What that can mean going forward is that production across the United States could be at record levels given good growing conditions, should that occur in 2024. Much of what is driving these future markets is the anticipation of this higher production level and challenges on the trading front with a strong U.S. dollar to boot. Ending stock projections for corn could reach one of the highest levels since the late 1980s should projections ring true. With that concern in mind, it prompts the question as to how the farmer and banker can respond?

In our world, this means that conversations with farmers early in 2024 are all that more important as expectations are set for the coming crop year. Conversations should address the needs of the producer, alternative strategies for shortfalls, and plans regarding insurance coverage and marketing strategies. Not all that different than the annual conversations, but with more depth around the downside risk. Anticipating corn prices with a three or four leading the way hasn’t been a consistent concern over the last few years. Doing so will harken back a few years and with inputs elevated it leaves some concern.

In conclusion, some of the best steps row crop farmers and ag bankers can take are steps of preparation and communication. Farmers are a resilient bunch who have weathered the ups and downs of the rolling commodity cycles. Preparation and awareness will help each of them in this cycle as well. And the hope is that this is all premature speculation. The hope is that farmers in Wisconsin have a bumper crop, with international partners buying more, and a prosperous year ahead. We wish all the farmers the best as they tackle this next crop season.

Sommer is assistant vice president – ag and commercial loan officer at Bank of Brodhead. Sommer also currently serves on the WBA Agricultural Bankers Section Board of Directors.