Wisconsin Bank CEOs Report Positive Economic Conditions

WBA Releases Results of Bank CEO Economic Conditions Survey

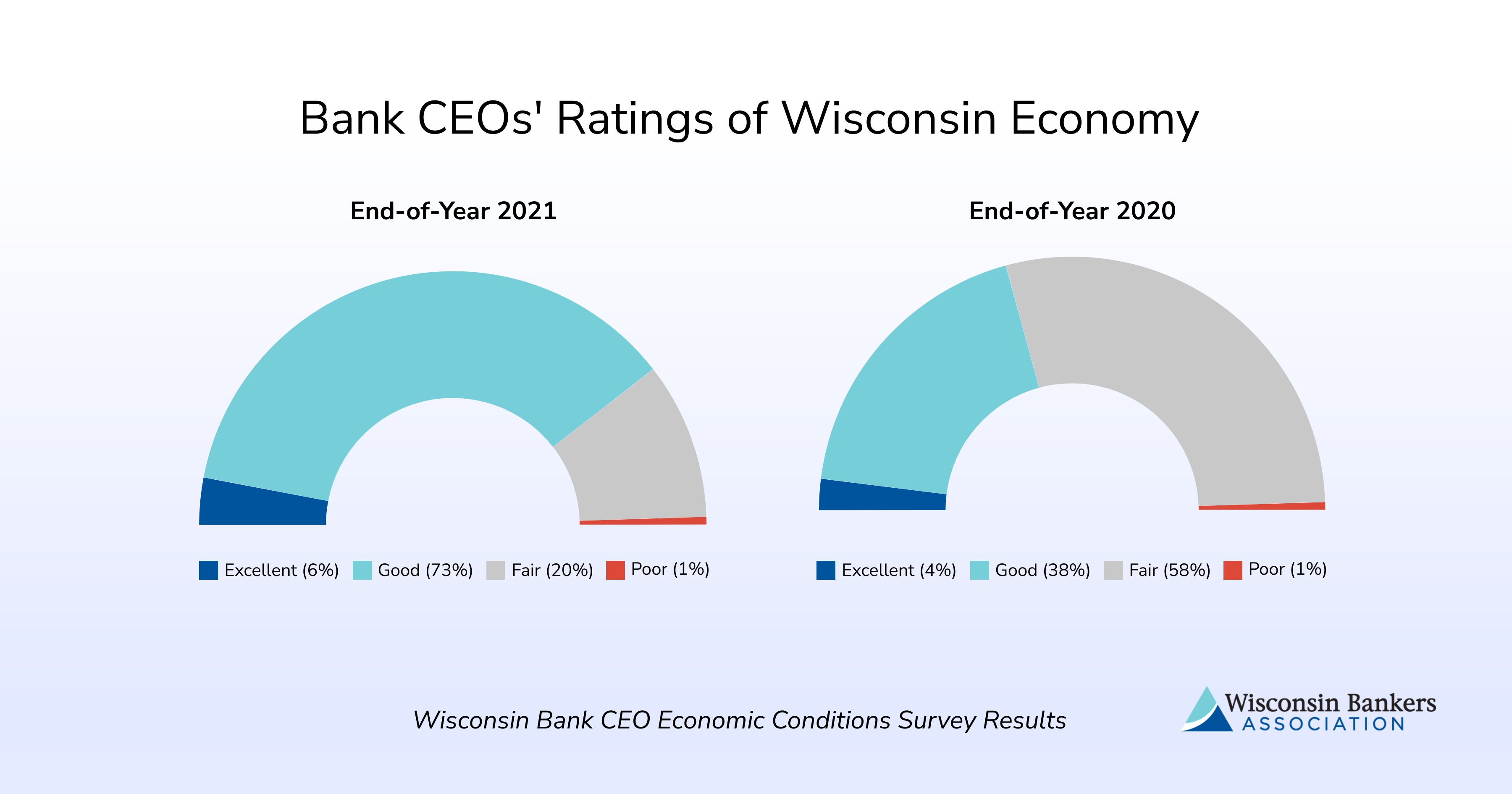

In the Wisconsin Bankers Association’s biannual Economic Conditions Survey of Wisconsin bank CEOs, 79% of respondents rated Wisconsin’s current economic health as “excellent” or “good.” This marks a significant increase since December 2020, when only 42% of survey respondents gave “excellent” or “good” ratings. Sixty-four percent of Wisconsin bank CEOs who completed the most recent survey predict that the economy will stay the same in the next six months, while 21% predict it will grow and 15% predict it will weaken.

“Wisconsin bank CEOs are in a unique position to gain insights into the microeconomic activities in their markets given the critical roles they play as lenders, advisors, and community leaders. As such, they often see developments occurring before economic trends are widely identified,” said WBA President and CEO Rose Oswald Poels. “As industries rebound — including tourism, manufacturing, construction, and agriculture — economic stability is taking hold.“

Many bank CEOs highlighted bright spots in their local economies such as low unemployment rates, strong consumer demand, a strong housing market, high commodity prices, growth in health care technology, and increased manufacturing and construction. Among the sources of economic concern for bank CEOs were inflation, new variants and waves of COVID-19, and workforce shortages and supply chain issues preventing businesses from realizing growth.

The end-of-year 2021 survey was conducted December 14–24 with 80 respondents. Sums may not equal 100 percent due to rounding. Below is a breakdown of the survey questions and responses.

Wisconsin Bank CEO Economic Conditions Survey Results

| How would you rate the current health of the Wisconsin economy. . . | End-of-Year 2021 | Mid-Year 2021 | End-of-Year 2020 |

| Excellent | 6% | 15% | 4% |

| Good | 73% | 76% | 38% |

| Fair | 20% | 10% | 58% |

| Poor | 1% | 0% | 1% |

| In the next six months, do you expect the Wisconsin economy to. . . | |||

| Grow | 21% | 48% | 45% |

| Weaken | 15% | 39% | 14% |

| Stay the same | 64% | 13% | 41% |

| Rate the current demand in the following loan categories: | |||

| Business | |||

| Excellent | 9% | 10% | 4% |

| Good | 48% | 30% | 29% |

| Fair | 39% | 52% | 56% |

| Poor | 5% | 8% | 12% |

| Commercial Real Estate | |||

| Excellent | 11% | 13% | 4% |

| Good | 44% | 44% | 30% |

| Fair | 41% | 33% | 52% |

| Poor | 4% | 10% | 14% |

| Residential Real Estate | |||

| Excellent | 25% | 40% | 63% |

| Good | 48% | 48% | 29% |

| Fair | 24% | 12% | 8% |

| Poor | 3% | 0% | 0% |

| Agricultural | |||

| Excellent | 1% | 2% | 0% |

| Good | 22% | 34% | 19% |

| Fair | 58% | 56% | 59% |

| Poor | 18% | 8% | 22% |

| In the next six months, do you anticipate the demand for the following loan categories will. . . | |||

| Business | |||

| Grow | 28% | 43% | 39% |

| Weaken | 14% | 7% | 13% |

| Stay the same | 59% | 51% | 48% |

| Commercial Real Estate | |||

| Grow | 24% | 31% | 32% |

| Weaken | 21% | 8% | 25% |

| Stay the same | 55% | 31% | 43% |

| Residential Real Estate | |||

| Grow | 11% | 14% | 20% |

| Weaken | 56% | 41% | 40% |

| Stay the same | 33% | 46% | 39% |

| Agricultural | |||

| Grow | 15% | 18% | 20% |

| Weaken | 14% | 6% | 15% |

| Stay the same | 71% | 76% | 65% |

| In the next six months, are the businesses in your bank’s market area likely to. . . | |||

| Hire employees | 68% | 82% | 30% |

| Maintain current staffing levels | 33% | 15% | 62% |

| Lay off employees | 0% | 3% | 8% |

| In the next six months, is your bank likely to. . . | |||

| Hire employees | 55% | 48% | 34% |

| Maintain current staffing levels | 43% | 45% | 65% |

| Lay off employees | 3% | 6% | 1% |